3 |

3 |

2 |  3 |

3 |

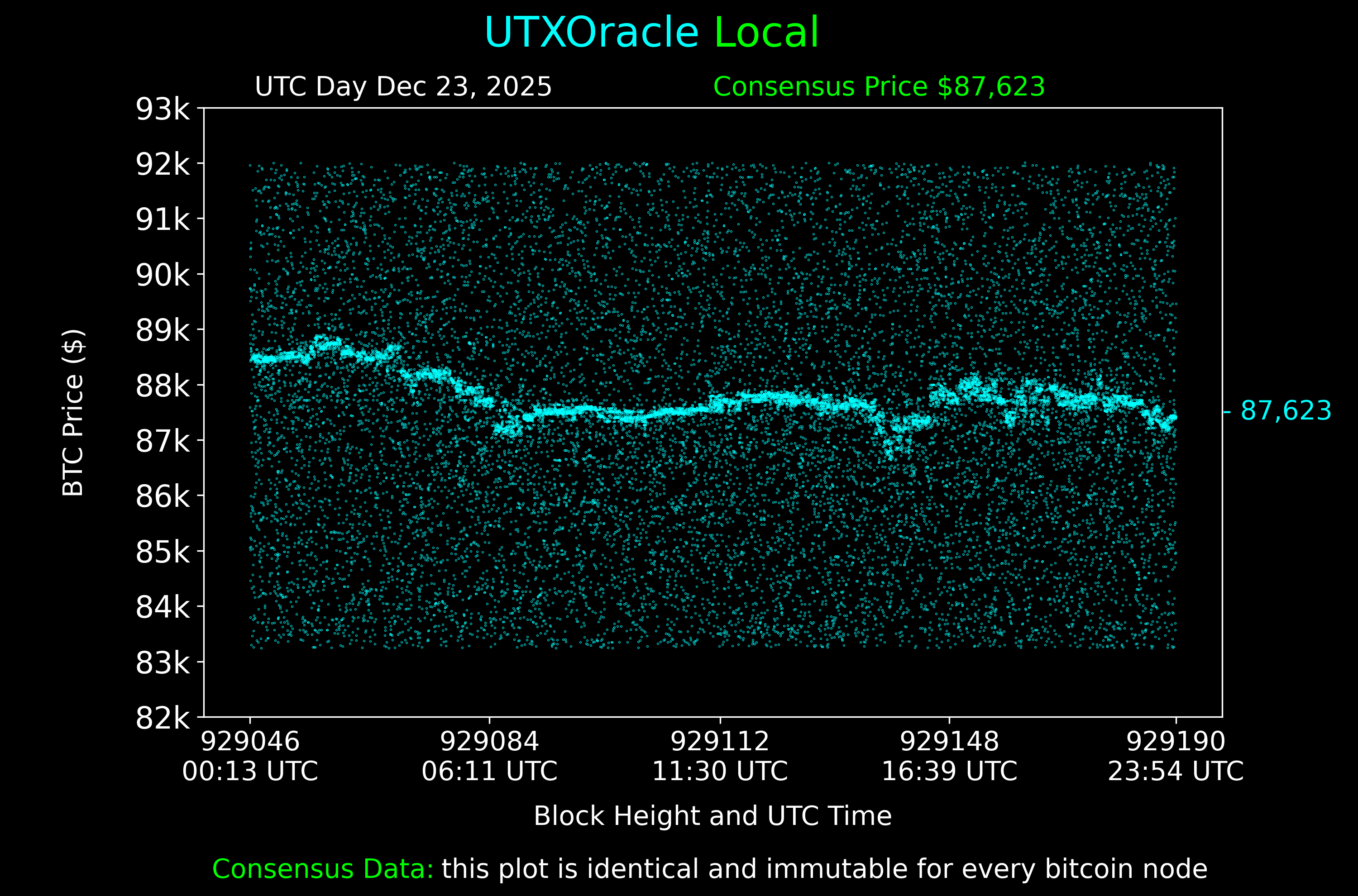

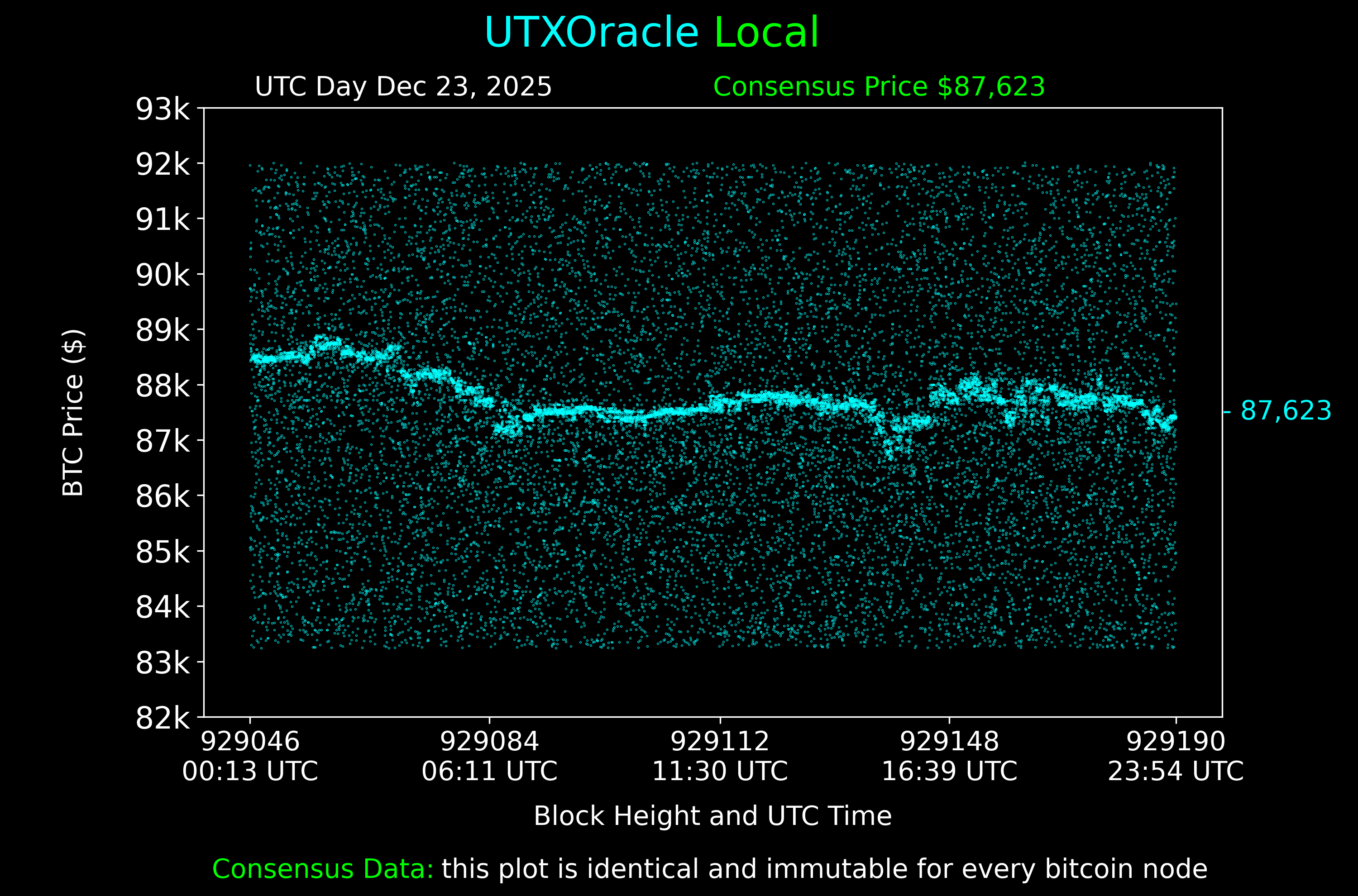

87 | Signal from noise. 88 |