├── README.md

├── notes

├── 20190620-meeting-governance-cn.md

├── 20190620-meeting-governance-en.md

├── 20190623-meeting-governance-cn.md

├── 20190623-meeting-governance-en.md

├── 20190630-meeting-governance-cn.md

├── 20190630-meeting-governance-en.md

├── 20190703-meeting-governance-cn.md

├── 20190703-meeting-governance-en.md

├── 20190707-meeting-governance-cn.md

├── 20190707-meeting-governance-en.md

├── 20190710-meeting-governance-cn.md

├── 20190710-meeting-governance-en.md

├── 20190714-meeting-governance-cn.md

├── 20190714-meeting-governance-en.md

├── 20190717-meeting-governance-cn.md

├── 20190717-meeting-governance-en.md

├── 20190721-meeting-governance-cn.md

├── 20190721-meeting-governance-en.md

├── 20190728-meeting-governance-cn.md

├── 20190728-meeting-governance-en.md

├── 20190801-meeting-governance-cn.md

├── 20190801-meeting-governance-en.md

├── 20190819-meeting-governance-cn.md

├── 20190819-meeting-governance-en.md

├── 20190826-meeting-governance-cn.md

├── 20190826-meeting-governance-en.md

├── 20190828-meeting-governance-cn.md

├── 20190828-meeting-governance-en.md

├── 20190924-wtfmeeting-governance-en.md

├── 20190929-wtfmeeting-governance-en.md

├── A_Response_to_YellowHat_Gov_Call_20191201.md

├── DeFi.WTF Banner.jpg

├── DeFiHackathonRecap.md

├── MacroWTF_Archive.md

└── images

│ └── apache-arch.png

└── research

├── BME.md

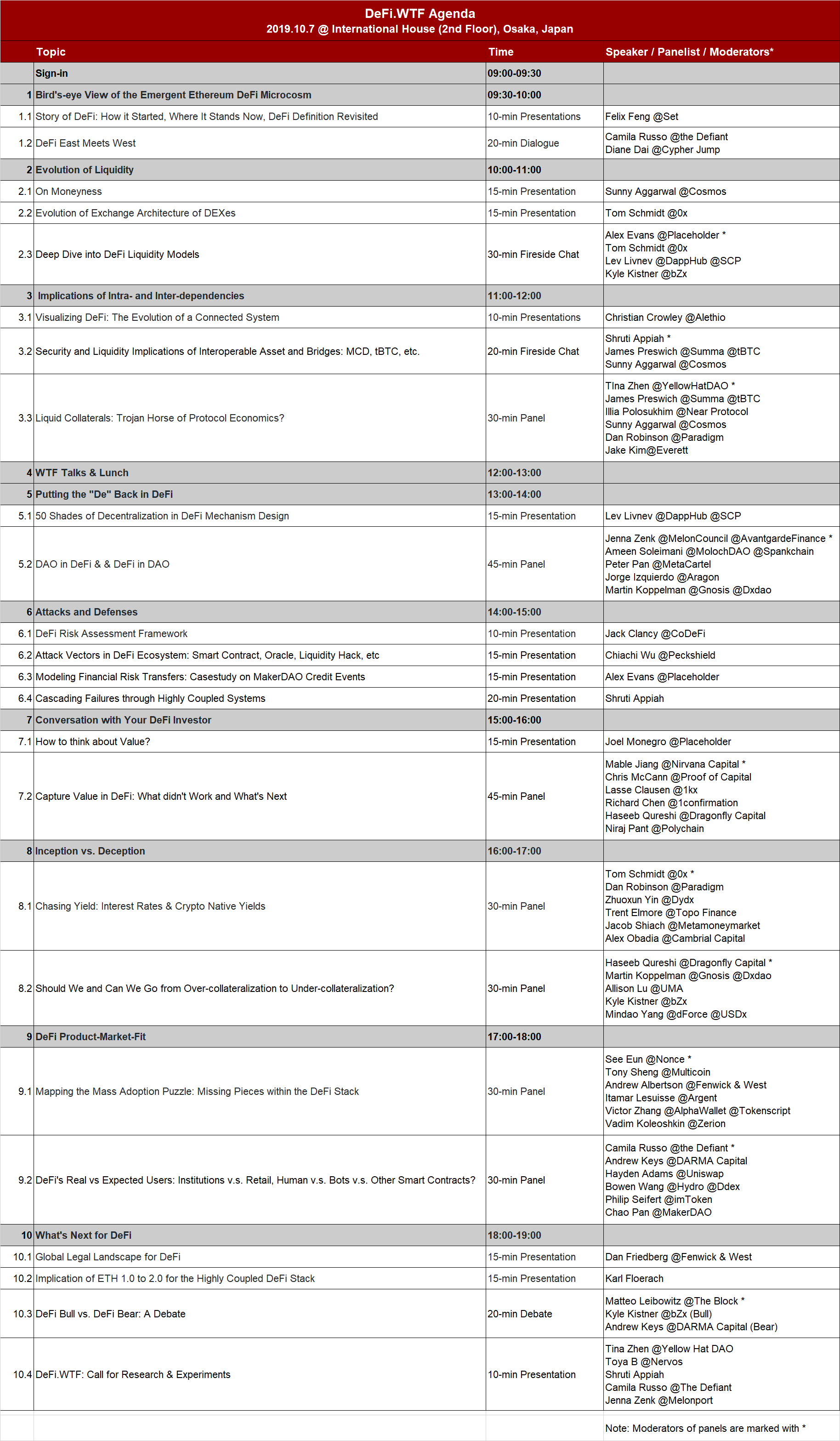

├── DeFi.WTF Agenda Working Draft-2.png

├── DeFi.WTF_Agenda.md

├── DeFi.WTF_KV_Banner.jpg

├── Difficulty future market size.xlsx

├── HashedgeAuctionMarket.md

├── Honeylemon

├── HoneyLemonWhitepaper.md

├── MarketProtocolV2Approach.md

├── TechnicalDesign_img1_OverallFlow.png

├── TechnicalDesign_img2_OrderFlow.png

├── TechnicalSpec.md

└── WhitePaper_BMRIformula_LaTex.png

├── LSDai.md

├── LSDao.md

├── TokenizedSyntheticMiningContract.md

├── Updated DEFI.wtf Agenda.png

├── f1-1.png

├── f1.png

├── f2-1.png

├── f2.png

├── f3-1.png

├── f3.png

├── f4-1.png

├── f4.png

├── f5-1.png

├── f5.png

├── f6.png

├── f7.png

├── hashrate-derivative-cn.md

└── hashrate-derivative-en.md

/README.md:

--------------------------------------------------------------------------------

1 | # Yellow Hat DAO (aka Pi-rate $HIP)

2 | Keepers of free capital market, starting from blockchain infrastructure.

3 |

4 | We are the Yellow Hats who play with decentralized financial primitives to experiment with crypto-native problems, in such way that tests the limit of cryptoeconomics. We wear Yellow Hats as construction workers, who make the infrastructure more robust by building the inevitables that may break the weaker ones.

5 |

6 | The Yellow Hat DAO is a social experiment itself, emerged out of the need to pool research and capital across interesting independent initiatives. Interdisciplinary collaboration on Community GitHub can and will be recorded at the present and accounted for in the future. The Yellow Hats participate in the community on an individual bases, projects compete for resources within the organization, retain independence from each other, and maintain their own value-capture models.

7 |

8 | Our GitHub Organization is a common co-creation space for the Yellow Hats in ideation and prototyping experiments. New project ideas, or research directions that fit the Yellow Hat Dao mission, may be posted as an [Issues](https://github.com/carboclan/pm/issues) . You may also post your comments or questions on existing project or research as [Issues](https://github.com/carboclan/pm/issues) or directly create a Pull Request. Outstanding Issues will be addressed in the Yellow Hats Community Semi-weekly Governance Call.

9 |

10 | Documentation and updates on Yellow Hats' live projects may be found in **Project Management Resources and Docs** below. We are soliciting suggestions from the Community on **Contribution Guideline** and **Community Governance**.

11 |

12 |

13 | ## Project Management Resources and Docs

14 |

15 | ### Buidl (Community Projects)

16 |

17 | #### 1. HoneyLemon (Hashedge)

18 | ##### Phase 2: HoneyLemon Mining Revenue Contract & dApp: Liquid Mining Derivatives

19 | - **A16Z Crypto Startup School Project / SF FlashGirls Pi-rate $HIP Flash Org**

20 | - Core Contributors:

21 | - @talrasha007 @carboclanc @jin10086 : [www.honeylemon.market](https://www.honeylemon.market/)

22 | - @andrei-aisimov @chrismaree @carboclanc @FSM1 @dmvt :

23 | - [28-Day BTC Mining Revenue Contract](https://github.com/carboclan/dapp.honeylemon.market/blob/master/Docs/BTCMiningRevenueContract.md)

24 | - [Technical Documentation](https://github.com/carboclan/dapp.honeylemon.market/blob/master/design/technical-architecture.md)

25 | - @andrei-aisimov @jie85 @longyunlyd: Market Making Strategies & Pricing

26 |

27 | ##### Phase 1: HoneyLemon.market: Cloud Mining Contract Aggregator

28 | - **Consensys Tachyon Accelerator / NY FlashGirls Pi-rate $HIP Flash Org**

29 | - Core Contributors: @talrasha007 @carboclanc @jin10086

30 | - Website: [www.honeylemon.market](https://www.honeylemon.market/)

31 |

32 | ##### Phase 0

33 | **Hashedge: Decentralized Marketplace for Generalized Mining**

34 | - **Winning hack @EthSingapore 2018, 0x prize @EthNY 2019**

35 | - Core Contributors: @talrasha007 @CarboClanC @nyuspc @tzhan28

36 | - Introduction [to be updated]

37 | - Website: [www.hashedge.io](https://www.hashedge.io/)

38 | - Product Demo: [Hashedge Alpha v0.3](http://demo.hashedge.io/) on Ropsten Testnet, for testnet tokens please sign up follow instruction on [www.hashedge.io](https://www.hashedge.io/)

39 | **BME(Bitcoin Mining Earnings) Index Futures: Tokenized Synthetic PoW Mining Contract**

40 | - Core Contributors: @jie85 @CarboClanC @Mikefotiaoqing @tzhan28

41 | - Introduction [en](research/hashrate-derivative-en.md) [cn](research/hashrate-derivative-cn.md)

42 | - [BME data](https://github.com/carboclan/pm/blob/master/research/BME.md)

43 | **CoinCow: Fair Coin Mining, Fun Cow Milking! (A crypto social satire born out of a dream.)**

44 | - Core Contributors: @CarboClanC @talrasha007 @Xi0ng

45 | - Concept Video: [CoinCow in 60 Seconds](https://www.youtube.com/watch?v=x6eRwmhyLt4&feature=youtu.be)

46 |

47 | #### 2. Liqui3D: Fomo3D x Liquidity Mining

48 | - **Grand Prize @DeFi Hackathon San Francisco Blockchain Week 2019, 1st Place in Cosmos Tendermint Challenge**

49 | - Core Contributors: @Dominator008 @ShrutiAppiah @alanywang @CarboClanC

50 | - Introduction: [Devpost](https://devpost.com/software/liqui3d-by-team-adjust) | [Slides](https://docs.google.com/presentation/d/1HWbNjYh7EQNKyv4GThJrusJsMEPzdDp3BQrK3pemikw/edit) | [Doc](https://docs.google.com/document/d/14VyCw5Ir7mJ9DbZzCXVJHuzJhVoUgr9Jbe2cWkHTe_Y/edit?usp=sharing)

51 | - [Github Repo](https://github.com/carboclan/liqui3d)

52 | - [DeFi Hackathon Recap](notes/DeFiHackathonRecap.md)

53 |

54 | #### 3. LSDai: Get high on Interest!

55 | - **Winning hack @ETHBerlinZwei 2019**

56 | - Core Contributor: @dmvt @hellwolf @kobuta23 @CarboClanC @leafcutterant

57 | - Introduction [en](research/LSDai.md)

58 | - Product Demo: www.LSDai.market

59 |

60 | #### 4. $HIP:

61 | - Core Contributors: @renchuqiao @jenil04 @Carboclanc

62 | - Intro Video: https://www.youtube.com/watch?v=G56CZ12M1WY

63 | - Demo: https://hip-app-api.herokuapp.com/

64 | - Repo: https://github.com/carboclan/hip

65 |

66 | ### Ask (Experiments)

67 |

68 | #### 1. .WTFdao

69 | - Macro.WTF Summit: http://macro.wtf/

70 | - [Archive for Slides & Video](notes/MacroWTF_Archive.md)

71 | - DeFi.WTF Summit: www.DeFi.wtf

72 | - Core Contributor: 21-Day Flashmob Collective that Dissolves on 10/8/2019

73 | - [Agenda](research/DeFi.WTF_Agenda.md)

74 | - [Archive for Slides & Videos](https://github.com/carboclan/pm/issues/69)

75 | - "A DeFi Billboard" Harberger Tax Social Experiment: [Repo]( https://github.com/carboclan/billboards-admin)

76 | - Quadratic Voting Toolkit: [Repo](https://github.com/carboclan/QVToolkit)

77 |

78 | #### 2. DAO & Decentralized Governance Research

79 | - [Accountability in Decentralized Networks: The MolochDAO Case](https://link.medium.com/8QB9u3KEfZ) by @Arikan

80 |

81 | #### 3. PoW vs. PoS Network Cartel Formation Analysis (Coming Soon!)

82 |

83 | #### 4. Cost of Liquidity Attacks (Coming Soon!)

84 |

85 | ### Meeting Notes

86 |

87 | #### 2019

88 |

89 | Date | Topic | Agenda | Notes | Summary |

90 | |:---|:---|---|---|:---|

91 | Dec 01 | Governance | - | [cn](notes/A_Response_to_YellowHat_Gov_Call_20191201.md) | 黄帽联盟进化论 Evolution of the YellowHats - A Letter to Community |

92 | Sept 29 | Governance | [Agenda](https://github.com/carboclan/pm/issues/69) | [en](notes/20190929-wtfmeeting-governance-en.md) [cn (tbc)](notes/20190929-wtfmeeting-governance-cn.md) | defi.wtf summit preparation |

93 | Sept 24 | Governance | [Agenda](https://github.com/carboclan/pm/issues/69) | [en](notes/20190924-wtfmeeting-governance-en.md) [cn (tbc)](notes/20190924-wtfmeeting-governance-cn.md) | defi.wtf summit preparation |

94 | Aug 28 | Governance | [Agenda](https://github.com/carboclan/pm/issues/60) | [en (tbc)](notes/20190828-meeting-governance-en.md) [cn (tbc)](notes/20190828-meeting-governance-cn.md) | Hashrate Derivative product design, governence |

95 | Aug 26 | Governance | [Agenda](https://github.com/carboclan/pm/issues/65) | [en (tbc)](notes/20190826-meeting-governance-en.md) [cn](notes/20190826-meeting-governance-cn.md) | Hashrate Derivative product design, governence |

96 | Aug 19 | Governance | [Agenda](https://github.com/carboclan/pm/issues/60) | [en (tbc)](notes/20190819-meeting-governance-en.md) [cn](notes/20190819-meeting-governance-cn.md) | Hashrate Derivative product design, governence |

97 | Aug 1 | Governance | [Agenda](https://github.com/carboclan/pm/issues/56) | [en](notes/20190801-meeting-governance-en.md) [cn (tbc)](notes/20190801-meeting-governance-cn.md) | Hashrate Derivative product design, governence |

98 | Jul 28 | Governance | [Agenda](https://github.com/carboclan/pm/issues/54) | [en (tbc)](notes/20190728-meeting-governance-en.md) [cn (tbc)](notes/20190728-meeting-governance-cn.md) | Hashrate Derivative product design |

99 | Jul 21 | Governance | [Agenda](https://github.com/carboclan/pm/issues/43) | [en (tbc)](notes/20190721-meeting-governance-en.md) [cn (tbc)](notes/20190721-meeting-governance-cn.md) | Index & Contract Design, product design |

100 | Jul 17 | Governance | [Agenda](https://github.com/carboclan/pm/issues/41) | [en](notes/20190717-meeting-governance-en.md) [cn](notes/20190717-meeting-governance-cn.md) | Index & Contract Design, product design |

101 | Jul 14 | Governance | [Agenda](https://github.com/carboclan/pm/issues/28) | [en (tbc)](notes/20190714-meeting-governance-en.md) [cn](notes/20190714-meeting-governance-cn.md) | Index & Contract Design, product design |

102 | Jul 10 | Governance | [Agenda](https://github.com/carboclan/pm/issues/27) | [en](notes/20190710-meeting-governance-en.md) [cn](notes/20190710-meeting-governance-cn.md) | Index & Contract Design |

103 | Jul 7 | Governance | [Agenda](https://github.com/carboclan/pm/issues/13) | [en](notes/20190707-meeting-governance-en.md) [cn](notes/20190707-meeting-governance-cn.md) | Community Governance and "Yellow Hat DAO" proposal, Index & Contract Design |

104 | Jul 3 | Governance | [Agenda](https://github.com/carboclan/pm/issues/7) | [en (tbc)](notes/20190703-meeting-governance-en.md) [cn (tbc)](notes/20190703-meeting-governance-cn.md) | |

105 | Jun 30 | Governance | [Agenda](https://github.com/carboclan/pm/issues/6) | [en (tbc)](notes/20190630-meeting-governance-en.md) [cn](notes/20190630-meeting-governance-cn.md) | Hashrate Derivative v1.0 White Paper Draft, Trade Offs of MARKET Protocol Integration |

106 | Jun 23 | Governance | [Agenda](https://github.com/carboclan/pm/issues/1) | [en (tbc)](notes/20190623-meeting-governance-en.md) [cn](notes/20190623-meeting-governance-cn.md) | Mission, Organization Principle, Hashrate Derivative v1.0, Reconciliation with Hashedge |

107 | Jun 20 | Governance | | [en](notes/20190620-meeting-governance-en.md) [cn](notes/20190620-meeting-governance-cn.md) | Carbo Clan Community vision, UMA and Other Derivative Protocols |

108 |

--------------------------------------------------------------------------------

/notes/20190620-meeting-governance-cn.md:

--------------------------------------------------------------------------------

1 | # 会议纪要:管理会议,2019年6月20日

2 |

3 | 社区管理会议于北京时间2019年6月20日22点在北京线下召开,历时3小时。

4 |

5 | **社区与会人员有:**

6 |

7 | - 天然

8 | - Tina

9 | - Liu Jie

10 | - 驴子

11 | - Mike

12 |

13 | ## 议程及行动

14 |

15 | ### 1. 议程评审

16 |

17 | 本次会议临时召开没有事先沟通议程。

18 |

19 | ### 2. 过往会议后续行动跟进

20 |

21 | 无

22 |

23 | ### 3. 社区愿景

24 |

25 | - _Tina:_ 社区内有POW和POS这两类参与者,可能存在一致的目标和不一致的路径。POW方偏向项目落地和可执行,认为当下POW入手算力衍生品更加容易落地。POS方认同长远目标但认为算力衍生品在POS上可以更优雅的实现且可以解决POS质押的流动性问题。为了最大化的吸引PoS和PoW的资源,社区的愿景应该涵盖这两类目标,统一PoW和PoS需求,为Web3下的基础设施提供保障。

26 | - _Liu Jie:_ 虽然不反对PoS,但PoS的流动性问题不是因为缺少衍生品造成,而是本身的共识不够大造成的。

27 | - _Mike:_ 同意 _Liu Jie_ 的观点

28 | - _Tina:_ 在统一个社区内,可以细分为各个小组做不同的方向,又可以相互借鉴资源。

29 | - _Liu Jie:_ 同意类似GNU组织下,可以有不同的项目

30 |

31 | - _Tina:_ 我们提出过的使命是让天下没有难挖的矿。

32 | - _天然:_ 觉得这个使命很好

33 | - _Liu Jie:_ 这个目标是否过大,如果是这个目标,那么算力衍生品只能算是其中很小的一个方向,诸如搞一个开源的BTC ASIC芯片可能是这个目标中更重要的方向。

34 | - _Tina:_ 我们提出这个更大的目标,竖起大旗,但可以从我们资源能及的方向起步做起来。

35 |

36 | - _Liu Jie:_ 我研究算力衍生品的初衷是因为看到算力投资人投入了大量资金,却承受了与之不匹配的超额风险,而矿机厂商和矿场经营者获取无风险收益且拿走了挖矿中的大部分利润。我个人研究算算力衍生品的目标是:通过金融衍生品,剥离挖矿风险,让投资挖矿的资金和风险相匹配,让挖矿市场更有效。

37 | - _Mike:_ _Liu Jie_ 提出的目标强调风险揭示和形成有效市场,Tina的目标强调降低挖矿门槛让更多人可以进入挖矿。

38 | - _Tina:_ 不矛盾,风险揭示后自然可以导向降低门槛的目标。

39 |

40 | ### 4. 算力合约v1.0

41 | - _Tina:_ 目前的版本可以称为v0.5,我们需要逐步向Liu Jie提出的架构发展。

42 | - _Liu Jie:_ UMA是一个很接近我们需求的底层协议,然而目前有两个严重的问题。1. UMA缺少投资组合保证金,造成不能关闭头寸,也不能做市。2.UMA的合约因一方保证金不足终止合约时守约方的利益不能保障继续执行,缺少转移合约及兜底的功能,实践中无法使用。我们有三个选择:1. 是否就在当前UMA上发展算力合约,暂时忍受上述问题。 2. 在UMA合约上完善补充这两个功能 3. 与UMA团队一起或者Fork一个版本完善UMA合约。

43 | - _驴子:_ UMA确实有这些问题。

44 | - _Tina:_ UMA团队进展较慢,我们需要自己搞或者再向其他团队学习。

45 | - _Liu Jie:_ 我有几个问题向UMA团队咨询后再做判断。

46 |

--------------------------------------------------------------------------------

/notes/20190620-meeting-governance-en.md:

--------------------------------------------------------------------------------

1 | # Meeting Notes: Governance, June 20 2019

2 |

3 | Governance meeting held @ 2PM [UTC](http://www.timebie.com/std/utc.php) in Beijing.

4 |

5 | **Community attendance:**

6 |

7 | - Tian Ran (Talyor)

8 | - Tina

9 | - Liu Jie

10 | - Lvzi (TAL)

11 | - Mike

12 |

13 | ## Agenda points & Actions

14 |

15 | ### 1. Agenda review

16 |

17 | The meeting was temporarily held without an advance communication agenda.

18 |

19 | ### 2. Action point follow ups from previous meetings

20 |

21 | None

22 |

23 | ### 3. Community vision

24 |

25 | - _Tina:_ POW and POS supporters coexist, they might have similar goal but disimilar path to achieve the goal. POW is more executable, as the hashrate derivative could become a executable legit business. POS side agrees on the longterm goal but think hashrate derivative could be conducted more elegantly on POS and could solve the liquidity issue of POS Staking. In order to maximize both POS and POW support and their resources, the community should be inclusive and compatible to both goals, and provide infrastucture to Web3

26 | - _Jie:_ Not a big fan of POS. POS liquidity problem is a lack of general concensus, not a lack of derivatives.

27 | - _Mike:_ seconded.

28 | - _Tina:_ Within one community, there can be several distinct groups focusing on different directions and share resources.

29 | - _Jie:_ Like GNU and Linux structure, different projects can coexist.

30 |

31 | - _Tina:_ Our Mission is to make all coins easily minable.

32 | - _Taylor:_ seconded.

33 | - _Jie:_: is this goal too grandeurs. If this mission is set, then hashrate derivative is only one of the many directions worth exploring. An opensource BTC ASIC mining chip could be more important.

34 | - _Tina:_ We could raise a big flag but focus on things with in our reach first.

35 |

36 | - _Jie:_ My initial impulse to dive in on hashrate derivative is that I saw many investor invested tons of money but bear supersized risks. On the other hand, mining rig manufacturers and mining field operators earned most of the profits without bearing much risks. My goal is to separate mining risks using derivatives so that risk and return corresponds.

37 | - _Mike:_ Jie wanted arisk revelation and efficient market. Tina wanted to lower the barrier to mine so that more people can access mining.

38 | - _Tina:_ Both goals can coexist. A revelation of risk can naturally lower the barrier.

39 |

40 | ### 4.Hashrate contract v1.0

41 |

42 | - _Tina:_ the current version should be named v0.5. We should gradually move toward the architechure Jie proposed.

43 | - _Jie:_ UMA is a protocol that fit our needs closely. However, two serious problems still lies between. 1.UMA lacks portfolio margin, which makes closing position and further, marketmaking impossible. 2. UMA 's contract will terminate when one side lacks margin, thereby cutting into the other side's interest. The contract with the lack of both transferability and gurantee of interest, has rendered unusable in practice. We have 3 choices: 1. use UMA as is, live with the problems. 2. Rectify UMA to fix the two aforementioned problems ourselves. 3. work with UMA to fix the problems or fork UMA

44 | - _TAL:_ UMA has those problems indeed

45 | - _Tina:_ UMA team progress slowly, we might need to do it ourselves or learn from other teams.

46 | - _Jie:_ I have a few questions that I need to ask UMA before make any further judgement

47 |

48 |

--------------------------------------------------------------------------------

/notes/20190623-meeting-governance-cn.md:

--------------------------------------------------------------------------------

1 | # 会议纪要:管理会议,2019年6月23日

2 |

3 | 社区管理会议于北京时间2019年6月23日10点-12点、22点-24点,在微信群线上召开。

4 |

5 | **社区与会人员有:**

6 |

7 | - 天然

8 | - Tina

9 | - Liu Jie

10 | - 驴子

11 | - Mike

12 | - ZT

13 |

14 | ## 议程及行动

15 |

16 | ### 1. 议程评审

17 |

18 | [提议的议案](https://github.com/carboclan/pm/issues/1)被会议接受。

19 |

20 | ### 2. 过往会议后续行动跟进

21 |

22 | 使命

23 | 在之前会议的基础上提出社区的使命: 让天下没有难挖的矿

24 |

25 | 讨论成果:

26 | 让天下没有难挖的矿是否合适做社区的目标?

27 | mike觉得可能对用户不够直观,矿工会有其他困难,刘杰也同意

28 | 叫公平挖矿如何,总之可以加形容词

29 | 刘杰:建立一套简单的挖矿的金融基础设施。

30 | mike&jie:使命可以务虚一点

31 | 新浩:公平也不太好

32 |

33 | 每个人想一个使命再评论

34 |

35 | 社区的组织原则

36 | 这是一个开放的社区,任何人只要认同社区使命都可以加入社区贡献力量。社区是非盈利性的,社区及社区成员都可以接受捐赠,但不接受任何以商业回报为目的的投资。在社区使命下,社区将发起若干项目。这些项目将有独立的经济模型,因项目需要也可以接受公平的商业投资。社区成员可以以个人名义投资这些项目。社区负责审核项目的投资人资质。社区是高度独立的,社区不对投资人负责也不对投资人做任何承诺。社区可以接受来自项目收益的捐赠以持续发展。

37 |

38 | 讨论成果:

39 | 问题:很多项目想交还给社区,结果发现交不回去还是原来一群人

40 | 早期共识不够大,后面也做不大

41 |

42 | 希望:社区接受捐赠但是不接受商业投资。底下的项目可以考虑接受投资,但要确保公平。社区成员可以投。社区可以审核投资人要提供资源,(需要界定权力边界)。投资人的收益权和投票管理权完全剥离。项目的商业收益可以还给社区。类似非盈利的concensus。

43 |

44 | tina觉得和原来设想相比没有矛盾点:coincow是第一个项目,hashedge是第二个

45 |

46 | 算力衍生品项目目标

47 | 算力衍生品项目是社区的第一批项目之一。算力衍生品项目的目标是:剥离挖矿风险,让投资挖矿的资金和风险相匹配,让挖矿市场更有效。

48 |

49 | 讨论成果:

50 | 选项 1难度 2算力单位产出,觉得2更合适矿工

51 |

52 | 投资者风险高,矿场矿机厂风险低收益高,希望变得匹配。做法是提供难度衍生品

53 | 剥离改成揭示(待议)

54 | zt:像vix,封装成独立产品 。利用算力难度衍生品向使用者提供关于算力难度的风险敞口(provide exposure to hashrate volatility)

55 |

56 | 算力衍生品项目的经济模式

57 | 算力衍生品项目在运营过程中的需要三类资源:

58 | 1. 流动性提供方。包括矿工、矿场、矿机厂商、区块链资管团队、交易所、OTC Broker 等等。流动性提供方的贡献度是以成交量衡量的,很难在初期确定资源方的贡献度。

59 | 2. 用于强行平仓兜底的资金。

60 | 3. 向社区捐赠用于后续发展的资金。

61 |

62 | 算力衍生品项目可能的商业收益来源:

63 | 1. 交易手续费,与之相关的是第一类资源。

64 | 2. 强行平仓罚金,与之相关的是第二类资源。

65 |

66 | 总体上,有两种分配收益的经济模式

67 | 1. 集中化的类股权方式。

68 | 流动性提供方也作为兜底资金提供方也作为捐赠资金提供方。由流动性提供方公平认购股权(或股权币),认购资金进入资金池用于强行平仓兜底和向社区捐赠。项目的收益不直接分配给股权投资人,而是进入资金池。

69 | 股权模式下,平台的核心参数(保证金比例、罚金比例等)由股权投资人决定。

70 | 2. 分散的方式。

71 | 分散方式没有类似股权的机制。交易手续费的全部或部分分配给提供流动性的资源方,类似销售渠道。任何人都可以对保证金不足的合约进行兜底,并获取强行平仓罚金。社区可以从上述收益中强行划分一定比例用于后续发展,也可以不设置硬性比例而是由收益人主动捐赠。

72 | 分散模式下,平台的核心参数(保证金比例、罚金比例等)由社区决定。

73 | 需要对上述经济模型进行讨论

74 |

75 | 讨论成果:

76 | 保障运营的资源

77 | 三类资源中的2很像bitmex的穿仓保险。

78 | zt说可以做成完全不会穿仓的,计算可以少一道

79 | 刘杰非常希望能给守约方以足够的保障。

80 | zt:找不到接盘的还是就爆仓就行了,不能强迫接盘,守约方会得到一些罚金。另一个保障的模式是保险,类似cds

81 |

82 | 罚金vs卖保险模型:在一方爆仓的情况下,另一方不同的人对保险的需求不一样,有些人有真实算力的真的要对冲必须买,trader不一定觉得需要,拿罚金就够了。

83 |

84 | 重要新成果:算力期货和cds。有了这两个工具以后挖矿就可以打包做成固收了

85 |

86 | 分配收益的经济模式

87 | tina:流转是否代币化现在不敢设计,

88 | zt:有币可以,但希望不止是股权,还得有点用。

89 | jie:mkr有点为了让币有用有点搞复杂了。是否有币。用户体验是否over utility币,这是不是硬标准

90 | tina觉得币的问题1脑子里都是炒币 2法律成本贵,

91 |

92 | 结论暂时搁置股权币问题

93 |

94 | 算力衍生品的早期交易模式

95 | OTC还是集合竞价。需要考虑流动性特点和技术上的难度。可以从OTC做起来,现在的UX应该也有大量可以直接用。

96 |

97 | 讨论成果:

98 | otc还是orderbook

99 | zt: orderbook合约必须一样,这样才能二级交易,坏处是撮合引擎大概率在链下

100 | otc可以定制,用不了统一的保证金,只能抵押物

101 | jie:往orderbook走的前提是标准化

102 | zt :场内效率高多了,占比40%+。大银行之间交易必须otc无法场外,我们做的场内的事情应该是兼容所有的需求的,没必要去搞场外了。

103 | 场内broker network可以自己做市。之前非标,不存在头寸代币化。现在标准化,头寸可以考虑代币化。但空头头寸估计不行因为敞口无限大。

104 | 成交以后可以mint token(这句前后文需要补充,没啥印象了)

105 | 驴子:新做一个otc代码相比我们现在的otc版本复用性很低,

106 | otc不存在cds,难在设计信用体系,default概率和之后定价。otc无监管风险,越像交易所越有合规风险

107 |

108 | 开个新issue,标准化的层次

109 | 如何达成交易层,头寸达成,orderbook otc还是程序化

110 | 保险/cds层

111 | 这个问题需要列出整个设计的结构以后才能综合讨论比较

112 |

113 |

114 | 新老交接和延续

115 | 讨论成果:

116 | 开发会议讨论:全力做新的?还是一起做

117 | 运营会议:运营目标,任务分解

118 |

119 | 交接方式:做成一个大文档,补上工程层面已经做的更领先的东西比如挖矿指数计算

120 | 游戏几十万能搞定,最近应该不重视

121 | web3 summit是重要时间点,观点是pos cartel formation,不公平。观点和数据要检查一下

122 |

123 | 算力衍生品项目的roadmap

124 | 讨论成果:

125 | 有0.5 1.0和2.0版本

126 | 设计目标:是能方便平仓又维持履约

127 | cds定义:期货没有cds,这里指减少穿仓的机制

128 | 保险定义1 爆仓不终止 2爆仓拿罚金。三种付钱垫底的人:买家 第三方 平台

129 | 用户端:都不是很关心,要保险的人听不懂cds,要罚金的不在乎cds。两种体验太不一样了,反正看需求

130 |

131 | 关于1.0版本:做项目不要依赖别的项目的进度,而uma挺慢的。另,1.0版本没用。。。因为买家也能跑路,双方都能跑的体验很差

132 |

133 | 文档结构问题:deribit文档很好 trader很关心。文档结构,搞清楚目地,tech导向还是金融导向。对码农来说二级交易没意义,只要标准肯定可以。刘杰这边会出一个新版

134 |

--------------------------------------------------------------------------------

/notes/20190623-meeting-governance-en.md:

--------------------------------------------------------------------------------

1 |

2 |

--------------------------------------------------------------------------------

/notes/20190630-meeting-governance-cn.md:

--------------------------------------------------------------------------------

1 |

2 | **630关于初版白皮书的讨论整理**

3 |

4 | # 白皮书

5 | ## 2.1.

6 | index公式让驴子发出来。

7 | Pps pay per share 矿池模式,买家不为矿池运气不好没出块而承担风险。zt有个平滑公式可能也需要用上

8 |

9 | 合约大小:1eth吗?现在没有传统的必须1份起或者一手起的问题,token随意分割。根据交易者习惯,把指数弄简单,放大到大家看着舒服的数。合约和头寸的单位必须一致

10 |

11 | 交割时间:到期区块高度比实际时间更准确。同时写出期望时间。

12 | Tina:整点交割符合trader习惯。

13 | Jie:可以先定期,但如果还没挖到跨调整的块,则自动延期。btc确实2016个块这样算周期比较重要。平台官方可以鼓励社区集中流动性到一些相对标准的合约上。避免augur这样的流动性过于分散。

14 | tina:加个像veil一样的ui

15 |

16 | ## 3.0.

17 | market拆开的思路很好,uma揉起来不一定是好事,不符合分层解决问题的逻辑。

18 |

19 | ## 3.2. 预言机

20 | btc没法插针,延时也不怕。可以自己跑个btc节点,这样数据来自链。

21 |

22 | mike:防我们自己中心化出错。有争议的话能解决吗

23 | uma设计了,分散oracle,投票,代理投票。预言机就投票和交叉验证两种。延迟交割的使用体验就不太好。可以考虑以后单独加强

24 |

25 | ## 3.3&3.4

26 | dydx问题1

27 | dydx不能直接对接,但暂时不会成为主要障碍

28 | dydx问题类似erc20 vs 721问题

29 | dydx在erc20外面又包了一层,所以别的交易所没法交易。

30 | 可以做个类似makerdao的机制,eth押着,dai可以交易,dydx可以做差不多的事情。

31 |

32 | Market mint的币肯定可以在dydx内流转,但是不能进入别的交易所。token在dydx合约地址里面。

33 |

34 | dydx问题2,market合约到期分红给dydx合约就懵逼了

35 | jie:有一招,到期前先全都平仓,尤其是带有dydx的market 合约token。需要对手方配合

36 |

37 |

38 | 如果dydx没空配合我们改,我们自己分叉dydx的话,就没有dydx生态内的流动性了。另外也可以看看ddex的做的怎么样。ddex上次称和dydx的主要区别是可以对接链下的做市商。

39 |

40 | 如果我们不想赚钱的话就把人拉进来就行。或者做流动性池子。可以把market生成的token直接丢进uniswap里面。makerdao早期的Oasis dex可以参考

41 |

42 | ## 4.

43 | 场景得补上做市商等。补ui,比如加个一键配资。封装不同的场景。需要讨论哪些是一个层面的

44 |

45 |

46 | # Governance相关:

47 | 以后双周会,周日上午1000,周三晚上1000。

48 |

49 | # 任务:

50 | 改进并翻译白皮书:标题要定好,部分专有名词和有歧义名词如swap的翻译问题,参考dharma,也多看别的各家defi白皮书。

51 | dydx的几个问题找对方聊

52 | 驴子发指数公式,大家对指数公式形成共识

53 | 讨论各场景分别位于哪个层面,哪些更重要,需要更优先的做

54 |

--------------------------------------------------------------------------------

/notes/20190630-meeting-governance-en.md:

--------------------------------------------------------------------------------

1 |

2 |

--------------------------------------------------------------------------------

/notes/20190703-meeting-governance-cn.md:

--------------------------------------------------------------------------------

1 |

2 |

--------------------------------------------------------------------------------

/notes/20190703-meeting-governance-en.md:

--------------------------------------------------------------------------------

1 |

2 |

--------------------------------------------------------------------------------

/notes/20190707-meeting-governance-cn.md:

--------------------------------------------------------------------------------

1 |

2 | # 会议纪要:管理会议,2019年7月07日

3 | 社区管理会议于北京时间2019年7月07日10点-12点30、在微信群线上召开。

4 |

5 | ## 社区与会人员有:

6 | 天然

7 | Tina

8 | Liu Jie

9 | 驴子

10 | Mike

11 | ZT

12 | xinhao

13 | 笑脸哥

14 |

15 |

16 | ## 1.1 指数设计

17 |

18 | 类似期权交易的iv。交易挖矿指数就旁边标注隐含难度

19 |

20 | 这个指数本质是难度分之一,其他都是常数。

21 |

22 | 每个随机量一个标的,不要混起来。所以不想带入挖矿手续费,block time等其他变量。

23 |

24 | 有实际意义的指数在挖矿世界可能会在小数点后面五六个零很不雅观。

25 | 常数两个层面,一是赋予实际意义,比如1t挖一天的产出。二是也看起来舒服,是一个小数点之前有三四位的正常数字。

26 |

27 | 另一个选项是直接用科学记数法来表示,这样把小数点后面的零都放入了科学记数法里面。

28 |

29 |

30 | ## 2.1 GNU/linux以及阿帕奇的组织架构 by Mike

31 |

32 |

33 |

34 | Apache运营的基本原则:

35 |

36 | 1精英主义(需要确认是不是meritocracy),主要反映在管理方式上,由各层级的精英小组,对议题进行投票决策,绝大多数人服从执行

37 |

38 | ——投票为3种,赞成,弃权,反对,投反对票的人,需要提出替补方案,否则反对无效

39 |

40 | ——精英小组面,投票权相等,没有权重

41 |

42 | ——任务认领采用类似google,或者说google借鉴了Apache的方式,由精英小组分解并评估任务,项目成员认领,完成后提交并维护,再由精英小组评估完成质量,给出评定

43 |

44 |

45 | 2按贡献值自下而上的晋升机制

46 |

47 | ——按贡献值进行由用户——》开发者——》提交者——》项目管理委员会 或者 会员——》基金会(ASF)——》董事会(具体贡献值计算方法,可以进一步了解,以衡量执行的效果)

48 |

49 | ——很少空降,Apache文化也不赞同空降

50 |

51 |

52 | 3基础设施完善

53 |

54 | ——基金会提供完善的项目管理,技术管理,品牌,公关,法务等服务,保证开发者顺畅参与,而不必为非技术层面的问题困扰

55 |

56 | ——项目孵化流程高效,Mike认为是Apache基金会的核心流程

57 |

58 |

59 |

60 | 面临的问题:

61 |

62 | 1项目补充新开发资源困难

63 |

64 | ——相当比例的高评级项目,是由商业组织支持的,比如hadoo由雅虎支持,个人开发者参与不足,导致项目进入Apache孵化流程后,无法补充新开发者,比较尴尬

65 |

66 |

67 | 2决策集中化

68 |

69 | ——大V抱团,因为会员的晋升,除贡献值外,也依赖于老用户的推荐,且在决策时不分权重,所以容易造成大V抱团,通过对自己有利的决议

70 |

71 |

72 |

73 | 讨论汇总:

74 |

75 | 1需要获得什么样的资源?由谁提供?(Mike)

76 |

77 | ——需要先回答本组织的目标是什么?实现此目标需要的资源是什么?

78 |

79 | ——如果目标是个人开发者无法参与的,比如linux基金会,主要是以linux的商业化为目标,依赖于大厂商的参与,所以会员以大厂商为主

80 |

81 | ——落实到本组织,比如目标是没有难挖的矿,那主要参与者应该是与挖矿产业链相关人员,但这里又分单纯挖矿,单纯交易,挖矿交易三类,需要考虑首先要引入什么资源

82 |

83 | ——提个思路供参考,比如主要做挖矿金融衍生品,那是不是设计一个通道,把具有金融能力的人,接入挖矿背景的技术团队(类似Tina+刘杰),这样本组织卖点明确,服务方式的设计,也有依据

84 |

85 |

86 | 2开发者参与研发流程是相对明确的,但推广,运营,市场的参与流程是不明确的?(刘杰)

87 |

88 | ——金融产品需要推广,但具有专业能力的人如何参与?如何计算贡献值,这个流程Apache没有给出范例(刘杰)

89 |

90 | ——提个思路,建议可计量的推广工作,由参与者承担,但不可计量的推广工作,由全职或兼职工作人员承担,Apache基金会的品牌推广,是这样操作的(Mike)

91 |

92 |

93 | 3 token的经济模型如何设计?(Tina)

94 |

95 | ——在核心流程的各环节上,做价值捕获,并尝试进行计量(Tina)

96 |

97 | —— token的获得如何与组织权益相结合,有收益的同时,也要有荣誉(Mike)

98 |

99 |

100 |

101 |

102 |

103 | ## 2.2 yellow hat dao by tina

104 | 相信自由市场奥派做空的人,需要组织联盟,是非主流观点。需要群策群力。

105 |

106 | Tina跟几个老外吃饭以后一起提出,成员包括near protocol的创始人乌克兰小哥illia ,曾提出用smart contract做跨连delegate pos,会break所有bft concensus。还有James prestwich设计过hashrate derivative,storj的联创。pow都nichehashable

107 | 总之基础设施不安全,需要为基础设施建立有效的市场。

108 | Yellow hat 之于carboclan有点像共产国际&中国共产党。我们是在中国主力干活的组织,外援们也需要有归属,方便大家一起做事

109 |

110 | Jie:名字有点怪,白帽黑帽只是tag不是名字,不会这么自称。

111 |

112 | ## 2.3 文档协作

113 | 三个级别的改动

114 | 第一层:简单修改直接改

115 | 第二层:表述调整就pull request 然后三个人review

116 | 第三层:大修改要开会讨论

117 |

118 | 目前三个人权限,tina 刘杰和天然

119 |

120 | 提issue要让所有人都看得懂,符合开源社区通用惯例

121 | 开源社区标准高于公司

122 |

123 | 提pull request以后可以再提问评论,

124 | 取决于问题级别,来决定要多少人来对这事情决策,小事情一两个人就够了,大事情要让更多人参与

125 |

126 |

127 | ## 进度

128 | 2讨论完了,1只讨论了1.1.1和1.1.3,剩余的下次再讨论

129 | 下次控制在2小时以内

130 |

--------------------------------------------------------------------------------

/notes/20190707-meeting-governance-en.md:

--------------------------------------------------------------------------------

1 |

2 | # Meeting minutes:Governance meeting,2019/7/07

3 | The community governance meeting took place on 10 am July 7th 2019

4 |

5 | ## attendees:

6 | tzhan28

7 | carboclanc

8 | BigTreeLiuJie

9 | Talrasha007

10 | Mikefotiaoqing

11 | longyunlyd

12 | juqiangl

13 |

14 | ## 1.1-1.3 Index Design & Contract Specs (issue #9)

15 |

16 | Note: Issue 9 is essentially about the trade off of Index scale, and Contract Size (which affects position tokens).

17 | The key considerations: ease of understanding of Index, v.s. ease of referring to Index, v.s. ease of understanding of how many contract tokens to buy given a certain need for hedging.

18 |

19 | Trading Mining Index could be similar to trading options, where Implied volatility is displayed on the side. Here the implied difficulty could be displayed next to the Index.

20 |

21 | 算力收益指数本质是难度分之一,其他都是常数。

22 |

23 | The nature of the Mining Index is the inverse of the difficulty. All else is constant.

24 |

25 | 每个随机量一个标的,不要混起来。所以不应该带入挖矿手续费,block time等其他变量。

26 |

27 | Variables (risks) should be decoupled. So the Mining Index doesnt include variables like transcation fees and block times.

28 |

29 | 有实际意义的指数在挖矿世界可能会在小数点后面五六个零很不雅观。

30 |

31 | Mining Index with real world meanings could have many decimals which looks messy. i.e 0.00000325btc for 1 Th/s per day.

32 |

33 | 常数两个层面,一是赋予实际意义,比如1t挖一天的产出。二是也看起来舒服,是一个小数点之前有三四位的正常数字。

34 | 另一个选项是直接用科学记数法来表示,这样把小数点后面的零都放入了科学记数法里面。

35 |

36 | The constant here has two levels of implications:

37 | 1. Give the Index a real world meaning (i.e. output per unit input).

38 | 2. Make the number a 3-4 digits number in the integer part so that traders can easily refer to it.

39 |

40 | The other option is to use scientific notation so that all the zeros go into the later part (10^x)

41 |

42 |

43 | ## 2.1 GNU/linux and Apache Software Foundation

44 |

45 |

46 |

47 | 对于参与者来说:自下而上,没有空降兵,被推选成为领导是一种个人荣誉,能力至上

48 | Among contributors it is meritocracy based, voted up by members, and it is an honor to be selected as a leader in Apache.

49 |

50 | 刘杰:做的doris捐给apache了。开源组织一个问题还是外部参与者太少,公司主导的项目很难社区化。如何承接是个问题。代码方面这么多年发展下来还比较方便,营销方面等就比较难

51 |

52 | Jie: worked on a project called Doris in Baidu, that was donated to Apache in the end. One problem with open source organization is lack of freelance participants outside of major organizations. Company oriented projects can hardly turn into community driven. Difficult to onboard new participants. Apache's organizational structure is good for code contribution. It's harder to quantify contribution from the business side.

53 |

54 | tina:解决方法是领任务然后各自去做。设计token赏罚机制,组织价值捕获与项目价值捕获两个层面要协调好。

55 | Mike: 我们需要先定原则,实践中完善

56 |

57 | Tina: To quantify and reward non-coding contribution, will entail clear definition of tasks and mechanism that encourages partcipation. It will likely involve token reward and punishment mechanism. Design token economics to reward and slash participants. Value capture in organization level and project level need to be aligned

58 | Mike: let's set ground rules first, then figure out the mechanisms based on these ground rules

59 |

60 | ### 2.3 principles of Apache

61 | 1. 精英主义(需要确认是不是meritocracy)对参与者要求严格,强自驱力

62 | 2. 自下而上的晋升机制

63 | 3. 能力和贡献值至关重要

64 |

65 | 1. meritocracy-based, high requirement of participation, self-driven;

66 | 2. bottom up internal promotion mechanism;

67 | 3. quantified contribution & capability

68 |

69 | 参与方式,晋升通道:b的参与和c的参与,要看到底我们需要什么资源,谁来提供资源和价值,他们之间什么关系。针对他们设计机制。

70 |

71 | Ways to participate: participation from both Businesses and individuals. It depends on what kind of resources does this organization need, who can contribute. How participants are related. Design mechanisms for them.

72 |

73 | Mike:linux和apache里面大部分都是商业组织完成,个人开发者比例一般。另外精英抱团比较严重。新人晋升仍然不容易,需要跟老人搞好关系

74 |

75 | Mike: most of the works in Linux and apache are done by companys. Percentage of individual developers is not high. Old members of the community tend to work together and block promotion passage for new members.

76 |

77 | Tina:精英主义和面向大b不可取。可取的是奖励阶梯,畅通的晋升方式。无法评论的:商业组织赞助为主是时代产物

78 |

79 | Tina: aganist elitism, pro meritocracy. Don't want the organization to be mainly facing businesses. Clear path to promotion should be adopted. Apache turned out to heavily rely on corporate donation or sponsorship may be a product of the past. We can do things differently now.

80 |

81 | mike:管理方式:人都很强,认领了就自己搞定,会自驱

82 | tina:三原则有点像pow+pos的结合。盈利组织可以参考steam/valve,consensys

83 |

84 | Mike: Something to learn from Apache, how to manage: self-driven.

85 | Tina: the 3 principles are like a combo of pow and pos. Refer to Valve and Consensys.

86 |

87 | ## 2.2 Proposal of "Yellow Hat DAO" - to build an efficient capital market for blockchain infrastructure

88 |

89 | 创建区块链基础设施的衍生品金融市场,因为会影响协议为保障其安全所设计的经济机制,就如同做空这个概念会是非主流的,可能会得罪项目方。但我们实则通过创建有效的金融市场,通过杠杆,做空,让好的协议更好的胜出,让共识小的协议的安全性问题暴露。有争议的世界最大的算力交易市场Nicehash是有价值的,在为矿工和算力需求方提供一个高效的交易市场的同时,也让人可通过付出成本购买算力的形式指定算力来攻击其他公链获利(为此社区计算出了各公链基础设施的“Nichehash-able”攻击成本),但是也让社区更清晰认知各链协议的安全性问题。需要凝聚一群奥派经济学相信自由市场力量的伙伴群策群力。

90 | Creating derivatives on PoW and PoS effectively is creating external incentives that can threaten the economics of some weaker protocols. Many protocol foundations may not like us. Just like shorting, it is not popular amongst mainstream. However, what we are doing is accelerating the market process, and create pressure on protocols to create defense against these attacks. The largest Hashrate spot market Nicehash has always been controversial. While having created an efficient trading marketplace for miners and their counterparties, it enable people to buy hashrate and conduct attacks on other chains at a cost (so-called Nicehash-able cost), but also raised awareness regarding the security issues that the protocols are facing. We should band together with other folks who believe in Austrian School of Economics and the free market.

91 |

92 | 黄帽联盟这个组织是在Tina跟几位公链协议创始人和意见领袖独立日聚会提出的。其中Near Protocol的创始人,曾提出用智能合约创建通过类衍生品机制实现跨链代理质押,这个机制会有可能break所有bft concensus。另外,参与者当中,Summa的创始人,原Storj联合创始人James Prestwich设计过算力保险。

93 |

94 | “Yellow Hat DAO” idea is created during a meetup with a few protocol founders/architects. Amongst the participants, Illia, co-founder of Near Protocol, has written a piece on "Staking & Delegation via Smart Contract", using smart contract and derivative like approach to achieve cross-chain delegation network, which can threaten essentially the weaker BFT consensus. Other participant include founder of Summa One and co-founder of Storj James Prestwich, who has designed Hashrate Insurance in the past.

95 |

96 | 黄帽联盟相对于碳基部落CarboClan,部落是发起方,黄帽联盟是国际组织?

97 | Yellow hat vs carbonclan : international & loosely organized vs initiator?

98 |

99 | Jie:名字有点怪,白帽黑帽只是tag不是名字,不会这么自称。

100 |

101 | Jie: the name yellow hat is weird, Black Hat and White Hat are tags not names. They don't call themself that. May need to verify the name with other hackers.

102 |

103 | ## 2.3 collaboration on documents

104 |

105 | 三个级别的改动

106 | 第一层:简单修改直接改

107 | 第二层:表述调整就pull request 然后三个人review

108 | 第三层:大修改要开会讨论

109 |

110 | 目前三个人权限,tina 刘杰和天然

111 |

112 | Three levels are modifications

113 | 1. simple grammar of typo, just change it

114 | 2. different wording. Use pull request and review by 3 people

115 | 3. major changes need to be discussed in governance calls

116 |

117 | 3 people have write access: Tina, Jie and Tianran

118 |

119 | 提issue要让所有人都看得懂,符合开源社区通用惯例

120 | 开源社区标准高于公司

121 |

122 | Issues need to be written clearly. Follow the common practice of mature open source projects. Their standard is higher than that of companies

123 |

124 | 提pull request以后可以再提问评论,

125 | 取决于问题级别,来决定要多少人来对这事情决策,小事情一两个人就够了,大事情要让更多人参与

126 |

127 | Pull request can be commented. Loop in necesary people to make decision on different subjects. Major issue require more participation

128 |

129 | ## Progress

130 |

131 | Finish with 2. Only done with 1.1.1 and 1.1.3. Propose new ideas and comment on 1.1.1 &1.1.3. The rest are up for discussions next time

132 | Keep the meeting under 2 hours next time

133 |

134 |

--------------------------------------------------------------------------------

/notes/20190710-meeting-governance-cn.md:

--------------------------------------------------------------------------------

1 | # 会议纪要:管理会议,2019年7月10日

2 |

3 | 社区管理会议于北京时间2019年7月10日22点-24点,在微信群线上召开。

4 |

5 | **社区与会人员有:**

6 |

7 | - 天然

8 | - Tina

9 | - Liu Jie

10 | - 驴子

11 | - Mike

12 | - ZT

13 |

14 | ## 议程及行动

15 |

16 | ### 1. 议程评审

17 |

18 | [提议的议案](https://github.com/carboclan/pm/issues/27)被会议接受。

19 |

20 | ## 1.1 指数设计和合约参数

21 | ### 1.1.0 指数公式

22 | 看 [issue9](https://github.com/carboclan/pm/issues/9) candidate 4

23 |

24 | 结论:指数如果支持精度的化就用btc,不支持就用聪。Contract size 如果聪,那么contract size这边要除以10^8

25 |

26 | 对冲30天的时候,不能直接乘30,以前可以这么做是因为之前non fungible,应该买一部分一个月,一部分2个月,一部分3个月?也不准确。

27 |

28 | 由于要对冲的是一系列连续的每天波动的单位算力产出,所以得用一段周期内的现金流的平均值。

29 | 这样产品已经过于复杂了,必须是专业人士才能操作,不直接给散户/矿工

30 |

31 | ### 组织形式

32 |

33 | 1. 基金会,底下几个不同项目可以盈利交税。认购折扣

34 | 2. 社团不institutionalize,只有各项目

35 |

36 | 过往成功的经验都是先一个核心项目,再带起来其他项目。consensys的直属项目叫bespoke,外围叫hub

37 |

38 | 一致意见是前期要花经费的就出;

39 | 但对于**钱的来源**:

40 | * jie:只拿不求回报的钱

41 | * mike:可以拿长线融资

42 |

43 | ### 总结:有预算审批制,一事一议,原则是要长线的钱,不能有无法兑现的承诺

44 |

45 | ### 提议:微信群内增加每日讨论,以缓解每次的开会讨论和决策压力。

46 |

--------------------------------------------------------------------------------

/notes/20190710-meeting-governance-en.md:

--------------------------------------------------------------------------------

1 | # Meeting minutes:Governance meeting,2019/7/10

2 | The community governance meeting took place on 10 pm Beijing time July 10th 2019

3 |

4 | ## Attendees:

5 | tzhan28

6 | carboclanc

7 | BigTreeLiuJie

8 | Talrasha007

9 | Mikefotiaoqing

10 | longyunlyd

11 | juqiangl

12 |

13 | ## Agenda Review

14 | The [agenda](https://github.com/carboclan/pm/issues/27) has been approved

15 |

16 | ## 1.1 index design and contract specs

17 | ### 1.1.0 The index formula

18 | See [issue9](https://github.com/carboclan/pm/issues/9) Candidate 4

19 |

20 | **Conclusion**: if market protocol support enough number of digits (probably need 12 digitss) then use btc as unit of account. If not, then use satoshi. In terms of contract size, if using satoshi, then the contract size need to be divided by 10^8

21 |

22 | In order to hedge 30 days of difficulty fluctuation, one cannot simply multiply by 30. It used to work since it was non-fungible. Buy partly 1 month, partly 2 month partly 3 month doesn’t work either.

23 |

24 | Since we are hedging a series of fluctuating unit hashrate daily mining output, an average of the cashflows within a period should be used. Therefore, this product is too complicated so that only professional traders can understand. It likely will not be miner or retail friendly.

25 |

26 | ## Organization & budgeting

27 |

28 | 1. Foundation with a few for-profit projects under the arch.

29 | 2. Do not institutionalize the organization, leave only the projects.

30 | Past expereince suggests that a core successful project could lead to a batch of new projects.

31 | The core projects in Consensys is called bespoke while the peripheral ones are called hub.

32 |

33 | **Concensus**: Budget approval . Discussion on every major proposal. Prinficle for funding is to only take long term money without promising anything that cannot be accomplished. The opinion diverge here with Jie suggesting only taking grants while mike is ok with long term investments.

34 |

35 | **Proposal**: add daily selected topic discussion on wechat group to alleviate pressure for the biweekly meeting.

36 |

--------------------------------------------------------------------------------

/notes/20190714-meeting-governance-cn.md:

--------------------------------------------------------------------------------

1 | # 会议纪要:管理会议,2019年7月14日

2 |

3 | 社区管理会议于北京时间2019年7月14日10点-12点在微信群线上召开。

4 |

5 | **社区与会人员有:**

6 |

7 | - 天然

8 | - Tina

9 | - Liu Jie

10 | - 驴子

11 | - Mike

12 |

13 |

14 | ## 1. 议程评审

15 |

16 | [提议的议案](https://github.com/carboclan/pm/issues/28)被会议接受。

17 |

18 | 会议议题:

19 |

20 | 1合约的设计

21 |

22 | ——目标:阶段性对合约的设计达成一致

23 |

24 | 2确定合约产品的设计要素(https://github.com/carboclan/pm/issues/32)

25 |

26 | ——目标:充份讨论,消除信息盲点,为实际进行产品设计做前期准备

27 |

28 | 3优化会议流程(https://github.com/carboclan/pm/issues/33)

29 |

30 | ——目标:通过有效决议,并实际执行

31 |

32 |

33 | ## 2 合约的设计 by Liu jie

34 |

35 | ZT于会议前,在微信中参与讨论

36 |

37 | 对合约设计达成共识,并关闭对应issues

38 |

39 | ——Synthetic PoW Mining Index formula #9(https://github.com/carboclan/pm/issues/9)

40 |

41 | ——Use Trading Days v.s. Block Height for Expiration? #19(https://github.com/carboclan/pm/issues/19)

42 |

43 | ——Trade off between Index Unit and Contract Size #20(https://github.com/carboclan/pm/issues/20)

44 |

45 |

46 | ## 3 确定产品要素 by Mike

47 |

48 | 1目标人群

49 |

50 | ——对冲者(矿工或云算力购买者):从事或了解挖矿业务,对风险有认知,需要对冲难度波动带来的收益风险,主要需求是锁定收益

51 |

52 | ——对冲者(固收基金):因为无法控制风险,导致不能入场,同样需要锁定收益

53 |

54 | ——投机者:了解行业,通过收集信息或技术分析,对全网算力和难度增长有预判的人,主要需求是获取收益,同时希望通过杠杆,扩大收益

55 |

56 | ——做市商:专业用户,使用能力强,只要有足够交易量,难用也会来

57 |

58 | ——问题:目前判断主要人群是对冲者,实际是对冲者出让部分利益,引来投机者和做市商

59 |

60 |

61 | 2核心价值

62 |

63 | ——剥离挖矿风险,让风险倾向型的资金承担风险并最大化收益,让风险规避型的资金回避风险

64 |

65 |

66 | 3目标场景

67 | ——对冲者:在买入,或意识到难度变化可能造成损失时,会产生控制风险的想法

68 |

69 | ——投机者:当自己了解的信息与多数对难度趋势判断不一致时,会产生投机的想法

70 |

71 | ——问题:如何插入用户场景?最好是能长期连接,当有收益下降,难度上升,算力增加的时候,能实时对用户主动推送,并做简报,类似于订阅,比如定位于,矿工人手一份的收益简报,在简报里加交易入口

72 |

73 |

74 | 4预期的使用方式

75 |

76 | ——保险:好处是能够匹配矿工要对冲的风险,覆盖风险敞口,可以完美嵌入挖矿业务,缺点是不标准,对非矿工用户友好度低

77 |

78 | ——交易市场:对赌,标准化,参与方便,缺点是不容易跟矿工要对冲的风险完全匹配

79 |

80 | ——问题:标准合约形式与个性化的挖矿风险不匹配,是否可以以交易市场为基础,尝试匹配对冲者需求,比如市场可以交易标准品,但对冲者也可以输入时间和算力,显示匹配的合约,然后一键交易

81 |

82 |

83 | 5预期的目标

84 |

85 | ——未讨论

86 |

87 | 6需要解决的运营难点

88 |

89 | ——未讨论

90 |

91 | ——更新问题:目标用户群有互补,可以通过运营控制不同类型用户的数量,以提高交易效率,但是不是初期做市商不好搞定?

92 |

93 |

94 | ## 4 优化会议流程 by Mike

95 |

96 | ——未讨论

97 |

98 |

99 | ## 5 进度

100 | 1,2.1,2.2.3,2.4讨论完成,2.5,2.6以及3未讨论

101 |

102 |

103 |

--------------------------------------------------------------------------------

/notes/20190714-meeting-governance-en.md:

--------------------------------------------------------------------------------

1 | # Meeting minutes:Governance meeting,2019/7/14

2 | The community governance meeting took place on 10 am Beijing time July 14th 2019

3 |

4 | ## attendees:

5 | Taylor

6 | carboclanc

7 | BigTreeLiuJie

8 | Talrasha007

9 | Mikefotiaoqing

10 | longyunlyd

11 | juqiangl

12 |

13 | ## Agenda Review

14 | The [agenda](https://github.com/carboclan/pm/issues/28) has been approved

15 |

--------------------------------------------------------------------------------

/notes/20190717-meeting-governance-cn.md:

--------------------------------------------------------------------------------

1 | # 会议纪要:管理会议,2019年7月17日

2 |

3 | 社区管理会议于北京时间2019年7月17日22点-24点在微信群线上召开。

4 |

5 | **社区与会人员有:**

6 |

7 | - 天然

8 | - Tina

9 | - Liu Jie

10 | - 驴子

11 | - Mike

12 | - ZT

13 |

14 | ## 议程及行动

15 |

16 | ### 1. 议程评审

17 |

18 | [提议的议案](https://github.com/carboclan/pm/issues/41)被会议接受。

19 |

20 |

21 | ## 1. 指数设计和参数设计

22 | 关于wbtc小数点位数不够, [详见issue46,已提供4种方案](https://github.com/carboclan/pm/issues/46)和 [pr48](https://github.com/carboclan/pm/pull/48)

23 |

24 | ## 2. 产品定位和初步设计

25 | [详见issue32](https://github.com/carboclan/pm/issues/32)

26 |

27 | 难度期货的市场规模:天然做, [详见这个表格](https://github.com/carboclan/pm/blob/master/research/Difficulty%20future%20market%20size.xlsx)

28 |

29 | 各参与方的决策流程和收益计算 [详见issue49](https://github.com/carboclan/pm/issues/49)

30 |

31 | mike估算产品工期

32 |

33 | ## 3. 治理

34 | Restructure our meeting format. Add daily discussion in specific topic on wechat. Shorten biweekly discussion length. [详见 issue33](https://github.com/carboclan/pm/issues/33)

35 |

36 | 剩余issue由天然分配讨论

37 |

38 |

39 |

--------------------------------------------------------------------------------

/notes/20190717-meeting-governance-en.md:

--------------------------------------------------------------------------------

1 | # Meeting minutes:Governance meeting,2019/7/17

2 | The community governance meeting took place on 10 pm Beijing time July 17th 2019

3 |

4 | ## Attendees:

5 | Taylor

6 | carboclanc

7 | BigTreeLiuJie

8 | Talrasha007

9 | Mikefotiaoqing

10 | longyunlyd

11 | juqiangl

12 |

13 | ## Agenda Review

14 | The [agenda](https://github.com/carboclan/pm/issues/41) has been approved

15 |

16 |

17 |

18 | ## 1. Index design and contract specs,

19 | Lack of precision in WBTC, [see issue46,4 proposals have been provided](https://github.com/carboclan/pm/issues/46)

20 |

21 | ## 2. Product positioning and initial design

22 | Basic elements of the product [see issue32](https://github.com/carboclan/pm/issues/32)

23 |

24 | Market size of Difficulty futures:by Taylor, [see spreadsheet](https://github.com/carboclan/pm/blob/master/research/Difficulty%20future%20market%20size.xlsx)

25 |

26 | Decision process and earnings calculation of each participants [see issue49](https://github.com/carboclan/pm/issues/49)

27 |

28 | Mike to give estimates on time requirement to finish the product

29 |

30 | ## 3. Governance

31 | Restructure our meeting format. Add daily discussion in specific topic on wechat. Shorten biweekly discussion length. [详见 issue33](https://github.com/carboclan/pm/issues/33)

32 |

33 | Taylor to delegate rest of the topics/issues to members

34 |

35 |

36 |

--------------------------------------------------------------------------------

/notes/20190721-meeting-governance-cn.md:

--------------------------------------------------------------------------------

1 | # 会议纪要:管理会议,2019年7月21日

2 |

3 | 社区管理会议于北京时间2019年7月21日10点-12点在微信群线上召开。

4 |

5 | **社区与会人员有:**

6 |

7 | - 天然

8 | - Tina

9 | - Liu Jie

10 | - 驴子

11 | - Mike

12 | - ZT

13 |

14 | ## 议程及行动

15 |

16 | ### 1. 议程评审

17 |

18 | [提议的议案](https://github.com/carboclan/pm/issues/43)被会议接受。

19 |

--------------------------------------------------------------------------------

/notes/20190721-meeting-governance-en.md:

--------------------------------------------------------------------------------

1 | # Meeting minutes:Governance meeting,2019/7/21

2 | The community governance meeting took place on 10 am Beijing time July 21th 2019

3 |

4 | ## attendees:

5 | Taylor

6 | carboclanc

7 | BigTreeLiuJie

8 | Talrasha007

9 | Mikefotiaoqing

10 | longyunlyd

11 | juqiangl

12 |

13 | ## Agenda Review

14 | The [agenda](https://github.com/carboclan/pm/issues/43) has been approved

15 |

--------------------------------------------------------------------------------

/notes/20190728-meeting-governance-cn.md:

--------------------------------------------------------------------------------

1 | # 会议纪要:管理会议,2019年7月28日

2 |

3 | 社区管理会议于北京时间2019年7月28日10点-12点在微信群线上召开。

4 |

5 | **社区与会人员有:**

6 |

7 | - 天然

8 | - Tina

9 | - Liu Jie

10 | - 驴子

11 | - Mike

12 | - ZT

13 |

14 | ## 议程及行动

15 |

16 | ### 1. 议程评审

17 |

18 | [提议的议案](https://github.com/carboclan/pm/issues/54)被会议接受。

19 |

--------------------------------------------------------------------------------

/notes/20190728-meeting-governance-en.md:

--------------------------------------------------------------------------------

1 | # Meeting minutes:Governance meeting,2019/7/28

2 | The community governance meeting took place on 10 am Beijing time July 28th 2019

3 |

4 | ## attendees:

5 | Taylor

6 | carboclanc

7 | BigTreeLiuJie

8 | Talrasha007

9 | Mikefotiaoqing

10 | longyunlyd

11 | juqiangl

12 |

13 | ## Agenda Review

14 | The [agenda](https://github.com/carboclan/pm/issues/54) has been approved

15 |

16 | Presentation mainly by Taylor on the existing four things we've created so far.

17 | Remaining major issues please see [issue 57](https://github.com/carboclan/pm/issues/57) and [issue 58](https://github.com/carboclan/pm/issues/58)

18 |

--------------------------------------------------------------------------------

/notes/20190801-meeting-governance-cn.md:

--------------------------------------------------------------------------------

1 | # 会议纪要:管理会议,2019年8月1日

2 |

3 | 社区管理会议于北京时间2019年8月1日晚上10点-12点在微信群线上召开。

4 |

5 | **社区与会人员有:**

6 |

7 | - 天然

8 | - Tina

9 | - Liu Jie

10 | - 驴子

11 | - Mike

12 | - ZT

13 |

14 | ## 议程及行动

15 |

16 | ### 1. 议程评审

17 |

18 | [提议的议案](https://github.com/carboclan/pm/issues/56)被会议接受。

19 |

--------------------------------------------------------------------------------

/notes/20190801-meeting-governance-en.md:

--------------------------------------------------------------------------------

1 | # Meeting minutes:Governance meeting,2019/8/1

2 | The community governance meeting took place on 10 am Beijing time August 1st 2019

3 |

4 | ## Attendees:

5 | Taylor

6 | carboclanc

7 | BigTreeLiuJie

8 | Talrasha007

9 | Mikefotiaoqing

10 | longyunlyd

11 | juqiangl

12 |

13 | ## Agenda Review

14 | The [agenda](https://github.com/carboclan/pm/issues/56) has been approved

15 |

16 | ## Logic to combine the 4 trading actions on market protocol [issue 57](https://github.com/carboclan/pm/issues/56)

17 |

18 | Buy long= sell short

19 | Buy short = sell long

20 | Buy long and buy short both occur=mint new pair

21 | Sell long and sell short both occur=redeem

22 |

23 | The combined effect: a future like derivative that has lower and upper bound. Can be long or shorted.

24 | Has a fixed collateral that cannot be topped up. The nominal price of the contract should be the index, which is essentially the long token price + the floor. The long token price* quantity in effect is the maintenance margin

25 |

26 | Jie is developing the combined version of market protocol on a forked hydro protocol.

27 | Logic can be given but a detailed product document won't be available until later.

28 | The combined version of market protocol can also be deployed on other centralized exchanges easily.

29 |

30 |

31 | ## Target User

32 | The prerequiste of designing a product must include identifiing the right target user.

33 | For hedging it could include mid to high level miner. For trading and speculation, the expertise required is significant. Casual trader and miner like Xinhao won't participate. Has to be Tal or Jie or ZT level trader.

34 |

35 | Tal as a arbitrage trader would like to see more third party data like the nicehash spot price

36 | Jie stated three major parameters before: implied difficulty, implied average difficulty increase in each cycle, implied profit margin

37 |

38 | ## On how to predict next difficulty.

39 | Two ways to calculate:

40 | 1. Use the past 2016 blocks.

41 | 2. Use the current cycle blocks (grow from 0 to 2016)

42 | Both have sound logic that should be considered.

43 |

44 | The hashrate 2016 1008 and 504 can also be taken into consideration.

45 |

46 | ## Data that should be displayed alongside the orderbook:

47 | Implied difficulty

48 |

49 | Implied average difficulty increase

50 |

51 | Implied leverage

52 |

53 | ## Calculator:

54 | At least two ways to appraoch

55 | 1. Input average difficulty increase

56 | 2. Input each of the diffciulty change included in the contract

57 |

58 | Data item like premium/discount, profit margin, should be secondary if not completely gone.

59 |

60 |

61 | ## Other Projects under Yellow hat dao

62 |

63 | Projects from our own: hashedge the cloudmining platform, coincow the game.

64 |

65 | Projects by Professor Burak

66 |

67 | Project with radical market

68 |

69 | Project by Suji and Minaji

70 |

71 | The consititution of this organization need to be formulated. Then the rules for admission and rules for projects to gain resources from the organization can be set.

72 |

--------------------------------------------------------------------------------

/notes/20190819-meeting-governance-cn.md:

--------------------------------------------------------------------------------

1 | # 会议纪要:管理会议,2019年8月19日

2 |

3 | 社区管理会议于北京时间2019年8月19日晚上10点-12点在微信群线上召开。

4 |

5 | **社区与会人员有:**

6 |

7 | - 天然

8 | - Tina

9 | - Liu Jie

10 | - 驴子

11 | - Mike

12 | - ZT

13 | - 明明

14 |

15 | ## 议程及行动

16 |

17 | ### 1. 议程评审

18 |

19 | [提议的议案](https://github.com/carboclan/pm/issues/60)被会议接受。

20 |

21 |

22 | 欢迎明明加入

23 |

24 | 产品版本号Product version specification:

25 | Mike: we should start with v0.2

26 | MM: we should use v0.2.0

27 | Conclusion with Consensus: v0.2.0

28 |

29 | 版本定义Version Definition:

30 | Mike: k线,order book,交易撮合,买卖,持仓

31 | MM:

32 | 1. 投资者入金方式?-第三方插件,

33 | 2. 入金币种?WBTC,

34 | 3. 合约发布前(Mint)发行流程?已简化没有发行角色,只有看多、看空两个角色。

35 | 第三方钱包 支持那些 明确出来0.2.0 这个版本

36 |

37 | 0.2.0目标:核心交易功能跑通

38 |

39 | 重要更新:

40 | 刘杰受启发,会让蒙特卡洛公司。做基于market protocol的类期货交易所,难度期货会是其中一个交易对。

41 |

42 | 界定清楚双方的边界以后,hashedge的重心将会落在提供指数上

43 | 一种是bme142884指数

44 | 另一头是每个block产出的指数

45 | 理论上要跑五个节点再随机用schnorr

46 | 才能让大家都信是个去中心化的

47 |

48 |

49 | 关于黄帽初衷:

50 | 提供做空渠道来实现整个区块链基础设施的有效市场

51 | Efficient mkt hypo 有效市场有三个要素

52 | 初期风险揭示,后期降低准入门槛

53 |

54 | 关于保险产品

55 | isda美国衍生品标准规范

56 | out of money call 就像insurance

57 | 控制住结构化产品的设计,让三方去卖保险和固收

58 |

59 |

60 | 组织mission价值观,边界定义清晰然后分内部外部,要有取舍

61 |

62 | 下次讨论wbtc

63 | 和整个集团名字和logo和slogan

64 |

--------------------------------------------------------------------------------

/notes/20190819-meeting-governance-en.md:

--------------------------------------------------------------------------------

1 | # Meeting minutes:Governance meeting,2019/8/19

2 | The community governance meeting took place on 10 am Beijing time August 18th 2019

3 |

4 | ## Attendees:

5 | Taylor

6 | carboclanc

7 | BigTreeLiuJie

8 | Talrasha007

9 | Mikefotiaoqing

10 | longyunlyd

11 | juqiangl

12 |

13 | ## Agenda Review

14 |

15 | ###Hashrate Derivative Product Initial Design

16 | ####1. Product version

17 | a. Mike: POC v0.2

18 | b. XMM: two-digit v0.2.0

19 | Conclusion with Consensus: start with v0.2.0

20 |

21 | ####2. Version definition

22 | a. Mike:

23 | i. v0.2.0 features: chart, order book, matching engine, trading interface, margins

24 | b. MM:

25 | i. Wallet supported? browser extensions (Metamask)

26 | ii. Currency for collateral accepted? WBTC,

27 | iii. Issuance process? Through modification of the MARKET protocol, the minter position has been simplified away, there is only long or short position two roles.

28 |

29 | ####3. The Practical Matters

30 | a. Jie’s proposal:

31 | i. Jie’s company Monte Carlo is currently designing and developing a full-functioning decentralized exchange on Ethereum, the MCDex, expected to launch in Oct 2019, which can list BME Futures.

32 | ii. Propose to merge Yellow Hat Community’s effort in building a DEX for BME Futures into Monte Carlo’s MCDex.

33 | iii. To concentrate liquidity, Monte Carlo’s MCDex should be the only interface for trading BME Futures.

34 | b. Tina’s concerns:

35 | i. Limiting trading interface for BME Futures only to MCDex is against the spirit of decentralization, tokenized long-short position pairs should be able to free float.

36 | ii. Given the specialized nature of BME Futures, Bitmex-like generalized trading interface of MCDex may not be user-friendly enough for miners’ and traders’ to understand the instrument.

37 | c. Conclusion with consensus:

38 | i. MCDex will incorporate a BME Index calculator for miners and traders, as specified in earlier community product discussion.

39 | ii. Yellow Hat Community can create an intro marketing page for BME Futures on community product “Hashedge”, and links to MCDex.

40 | iii. Jie will send over the latest UIUX design of MCDex for Yellow Hat community this week for review.

41 |

42 | ###Governance:

43 | Community project portfolio and organization: thoughts and feedbacks on the summary of current community project portfolio in the updated README:

44 | a. Mike: What are the criteria for community project selection? Project CoinCow seems a bit out of place.

45 | b. Tina: a simple governance scheme for the Yellow Hat Community will be proposed soon, after closing research on comparable organizations’ governance scheme. The proposal will incorporate the following aspects:

46 | i. Community Mission

47 | ii. Core values of Community

48 | iii. Governance process:

49 | 1. Community members’ entry and exit, induction process

50 | 2. Community project criteria, proposals, selection and QA

51 | 3. Peer review of members’ contribution

52 | iv. How does the Yellow Hat community contributors capture value from contribution to projects and research.

53 |

--------------------------------------------------------------------------------

/notes/20190826-meeting-governance-cn.md:

--------------------------------------------------------------------------------

1 |

2 | # 会议纪要:管理会议,2019年8月26日

3 |

4 | 社区管理会议于北京时间2019年8月26日晚上10点-12点在微信群线上召开。

5 |

6 | **社区与会人员有:**

7 |

8 | - 天然

9 | - Tina

10 | - Liu Jie

11 | - 驴子

12 | - Mike

13 | - ZT

14 |

15 | ## 议程及行动

16 |

17 | ### 1. 议程评审

18 |

19 | [提议的议案](https://github.com/carboclan/pm/issues/65)被会议接受。

20 |

21 |

22 | 期货产品首页UI几个小问题

23 | 首页k线图不够突出。已解决

24 | order和transcation打算怎么区分?按标配的来

25 | wallet是我们自己提供菜单还是直接靠metamask的?靠metamsk

26 |

27 | 后两个实际看刘杰这边怎么做

28 | tina的lsdai会成为mcdex上面又一个交易对

29 |

30 |

31 | 做一个大首页,底下包括云算力产品,期货产品,奶牛游戏,未来可能的保险产品。

32 |

33 | 视觉风格要统一一下,看起来像母子品牌,要有一个统一的slogan

34 |

35 | 天然出大首页的文字稿,然后明明简单做一个wordpress

36 |

37 | 另,天然填bitgo wbtc merchant的问卷https://docs.google.com/forms/d/1y-yQzUN8ym2Kzt0AQ2__Y8-FADvC-XiZcZizYU7-S9s/viewform?edit_requested=true%C2%A0

38 |

39 | 刘杰建议这些放到开发会议上,不要放在治理会议上

40 |

--------------------------------------------------------------------------------

/notes/20190826-meeting-governance-en.md:

--------------------------------------------------------------------------------

1 | # Meeting minutes:Governance meeting,2019/8/26

2 | The community governance meeting took place on 10 am Beijing time August 26th 2019

3 |

4 | ## Attendees:

5 | Taylor

6 | carboclanc

7 | BigTreeLiuJie

8 | Talrasha007

9 | Mikefotiaoqing

10 | longyunlyd

11 | juqiangl

12 |

--------------------------------------------------------------------------------

/notes/20190828-meeting-governance-cn.md:

--------------------------------------------------------------------------------

1 | # 会议纪要:管理会议,2019年8月28日

2 |

3 | 社区管理会议于北京时间2019年8月28日晚上10点-12点在微信群线上召开。

4 |

5 | **社区与会人员有:**

6 |

7 | - 天然

8 | - Tina

9 | - Liu Jie

10 | - 驴子

11 | - Mike

12 | - ZT

13 |

14 | ## 议程及行动

15 |

16 | ### 1. 议程评审

17 |

18 | [提议的议案](https://github.com/carboclan/pm/issues/60)被会议接受。

19 |

--------------------------------------------------------------------------------

/notes/20190828-meeting-governance-en.md:

--------------------------------------------------------------------------------

1 | # Meeting minutes:Governance meeting,2019/8/28

2 | The community governance meeting took place on 10 am Beijing time August 28th 2019

3 |

4 | ## Attendees:

5 | Taylor

6 | carboclanc

7 | BigTreeLiuJie

8 | Talrasha007

9 | Mikefotiaoqing

10 | longyunlyd

11 | juqiangl

12 |

13 | ## Agenda Review

14 | The [agenda](https://github.com/carboclan/pm/issues/56) has been approved

15 |

--------------------------------------------------------------------------------

/notes/20190924-wtfmeeting-governance-en.md:

--------------------------------------------------------------------------------

1 | # Meeting minutes:WTF Governance meeting,2019/9/24

2 | The community governance meeting took place on 1030 pm Beijing time Sept 24th 2019

3 |

4 | ## Attendees:

5 | Taylor

6 | carboclanc

7 | Bowen

8 | Diane

9 | Shruti

10 | Future from blockbeats

11 | Toya

12 | Suji

13 | Minako

14 | Xiangxiang

15 |

16 | ## Agenda Review

17 | Gather all possible resources to host Defi.WTF Summit

18 | Will discuss in subsections

19 |

20 | ## Summit Agenda & Speaker

21 |

22 | ### Type 1 curated sections

23 | We have 7 curated sections, 2-4 subsections udner each section. mostly still flexible.

24 |

25 | ### Type 2 WTF talks,

26 | similar to lightning talks. ie 8 minutes each.

27 | WTF talks are self proposed

28 | Option1 spread wtf talks whole day

29 | Option2 condense all wtf talks into 1 hour.

30 |

31 | ### Type 3: Solicit questions on online (twitter/github)

32 | questions could be added to curated topics or wtf talks

33 | Need a standard format for question submission

34 | Poll of best questions will also be conducted through the quadratic voting system.

35 |

36 | ### Update Sept 29

37 | We now have 10 Type 1 curated sections. WTF talks will be hosted at lunch all together instead of spreading whole day. Therefore we need catering. Some of the Type 3 questions have already been added to Type 1 and Type 2 talks. Some other Type 3 questions will be asked at different panels

38 |

39 | 70% of the Type 1 talks have been finalized?

40 | Type 2 self proposal have amounted to 4 ? We have a limit of 6?

41 |

42 |

43 |

44 | ## Online Marketing

45 |

46 | ### Twitter

47 | #### A specialized social media volunteer subgroup that inculdes Toya, Camila Bowen,Diane, Maybe Taylor, Xingxing?

48 | #### Camila will create some content to be twitted

49 | #### Twitter Campaign could be conducted together with the Type 3 questions above

50 | #### Bowen suggested creating some hashtag for the event to stimulate social media engagement.

51 | #### Diane suggested creating some posters to be spread around

52 | ——Taylor has already created the gif version of some of the posters with the lips moving

53 |

54 | ### Newsletter

55 | Bowen has a list. Some newsletters are every Friday, some are Monday.

56 | Proof of Work by Eric Meltzer on this Friday has already been sent out.

57 |

58 | ### Reddit

59 | Popular subreddits are r/ethereum, r/ethtrader, r/ethfinance, r/makerdao

60 | Bowen post threads Taylor be the first guy to upvote and reply?

61 |

62 | ### Telegram

63 | Telegram group has already been created

64 |

65 |

66 | ## Coverage

67 |

68 | Taylor will be the photographer if he makes it to Japan

69 |

70 | Chainnews will provide coverage including audio recording, audio-to-transcript, video live coverage, post-event video documentary. Some could be outsourced to other media partners like Blockbeats or Real Satoshi.

71 |

72 | Catering?

73 |

74 |

75 | ## Developments

76 | ### Website Update

77 | Mingming will be the designer

78 |

79 | ### BillBoard

80 | Minako will be in charge of the billboard,both back and front end?

81 |

--------------------------------------------------------------------------------

/notes/20190929-wtfmeeting-governance-en.md:

--------------------------------------------------------------------------------

1 | # Meeting minutes:Governance meeting,2019/9/29

2 | The community governance meeting took place on 1000 pm Beijing time Sept 29th 2019

3 |

4 | ## Attendees:

5 | Taylor

6 | carboclanc

7 | Bowen

8 | Diane

9 | Shruti

10 | Future from blockbeats

11 | Toya

12 | Suji

13 | Minako

14 | Xiangxiang

15 |

16 | ## Agenda Review

17 | Gather all possible resources to host Defi.WTF Summit

18 | Will discuss in subsections

19 |

20 | ## Summit Agenda & Speaker

21 |

22 |

23 | ### Update Sept 29

24 | We now have 10 Type 1 curated sections. WTF talks will be hosted at lunch all together instead of spreading whole day. Therefore we need catering. Some of the Type 3 questions have already been added to Type 1 and Type 2 talks. Some other Type 3 questions will be asked at different panels

25 |

26 | 70% of the Type 1 talks have been finalized?

27 | Type 2 self proposal have amounted to 4 ? We have a limit of 6?

28 |

29 |

30 |

31 | ## Online Marketing

32 |

33 | ### Twitter

34 |

35 |

36 | ### Newsletter

37 |

38 | ### Reddit

39 |

40 |

41 | ### Telegram

42 |

43 |

44 |

45 | ## Coverage

46 |

47 |

48 |

49 | ## Developments

50 | ### Website Update

51 |

52 |

53 | ### BillBoard

54 |

55 |

--------------------------------------------------------------------------------

/notes/A_Response_to_YellowHat_Gov_Call_20191201.md:

--------------------------------------------------------------------------------

1 | 黄帽联盟协作实验进化论 12.1.2019

2 |

3 | 碳这种元素的王者性质,乃是源于其平凡:碳做了大部分的事情,又不走极端,借助这种节制的本质,碳主宰了自然。

4 | -「Atoms, Electrons & Changes」by Peter Atkins

5 |

6 | 就今天的讨论,我思考了一下。个人意见是YellowHat社区与利益之间,我希望能够保持社区的真诚,希望真正能以开放心态,像@小岛美奈子@matataki.io 这样的小伙伴,在贡献中学习沉淀,认可有价值内容的分享,而不是给大家带来一种这里都是牛人我来功利social climb,或者我很牛我在牺牲自我过来帮你的这样的心态。这个社区里我希望没有一个人觉得自己在被消耗,被消费,而是一种在互相吸取和学习的过程。

7 |

8 | 这是一个价值观与文化层面的定位,是关乎于发起黄帽的初衷,这个社区(目前只是一个zoom电话会、微信群和GitHub作为沟通载体的群体,还不是一个严格意义上的组织)是在发起后大家在参与项目过程中沉淀的组织。

9 |

10 | 现在的黄帽社区的出现,是涌现的过程。因为出于对自由人自组织形态的探索欲望,开始痴迷研究挖矿mining和staking机制设计当中利益与治理的关系,有形与无形力量的市场博弈(tyranny of powerlessness),用利益协同的机制设计把公共品变成社会化公众品(turn public goods into common goods)。开始逐渐形成我自己对于通过机制设计提升异构资本协同效率(coordination of heterogeneous capital)的一些想法。

11 |

12 | 也是因为日有所思夜有所想,想到了算力上链,做梦梦到了荒谬而dystopia的算力🐄游戏CoinCow。

13 |

14 | 没有人能够预判曾经的来自一个梦到的奶牛🐄项目,能从一次失败的黑客马拉松开始。挖矿的金融衍生品领域太晦涩,奶牛游戏这个idea太雷了,找了一线的VC最后没过投委会。我们没有全职团队能做出来奶牛游戏的产品原型,我于是拉着我认为在技能值上🈶“超能力”却埋没在大公司打工和在各自项目上疲于奔命的小伙伴@talrasha007 @longyunlyd ,还有半道merge过来的Sigmenfault北京黑客马拉松的冠军团队汤包他们,组队去圣何塞参加Dorahacks的全球黑客马拉松。那是我们第一次的自由人的自由联盟快闪组织,也是在那里认识了同样飞去打比赛的@小岛美奈子@matataki.io 。

15 |

16 | 我记得我们在比赛后一起去冲浪了,去感受被海浪(像生活和市场一样)暴扁的痛和乐趣。那个时候我们第一次注了我们大家的GitHub组织,把黑客松的🐄代码放了进去,组织名叫CarboClan。Carbo碳基是Carbon的拉丁词根(寓意是人类文明),Clan是部落(Clan是爱打游戏的黑客松参赛小伙伴全票选择的名词,之前被大家否掉的词是lab)。也许,终有一天当碳基文明被硅基文明完全侵蚀,我们能找到一种组织形态留存碳基文明的火种,以一种新的形态繁衍下去。

17 |

18 | 为了不放弃一个玩具一样可笑的idea背后的商业价值,这是我和大家仅有的共同果实,我们把这个奶牛游戏的idea掰开了揉碎了一次又一次参加黑客马拉松,从碰壁失败到开始屡战屡胜,到以及没有初始黄帽小伙伴还能打得动黑客马拉松,所以只好到现场碰运气临时组队,意外收获是每次都能沉淀下来具备某种超能力但却无的放矢的新“黄帽”的小伙伴。每次比赛都是0资源启动、收益未知、36小时自由人利益联合体的快闪组织社会实验,身体心理在极端疲惫的高度不确定下最后几小时的推进、是不断需要自我暗示、相互signal、抓大放小、临时应变,最终才有可能完成所谓的“不可能”。

19 |

20 | 大家可能只能看到的是我们现在的各种进程中的项目,可是只有一起选择经历过的人,才知道一点点我们现在玩笑无数次曾被拒绝的故事。

21 |

22 | 在熊市创业的小伙伴都知道,在湾区、三番、纽约经常是多少次无数小时的等待结果后才换来一次投资人见面,然后没有下文。当时在“等待戈多”般的漫长不确定状态中,我有反复思考,如果能够社区互助的形式,让有只有少数人能看到其“超能力”但都不足以单枪匹马在国际战场上胜出能够不脱离自己的安全网(大公司的工作、自己的项目、自己的生活方式)还能取长补短自愿组队在自己感兴趣的方向进行实验,给自己留下至少一个由社区共同创造出来的选择权(option),那该多好。

23 |

24 | 创业九死一生的概率,而在区块链领域nothing has quite worked 的状态,对于参与者风险更高。即便这个选择权没有成功兑现,那么至少这个大家自嘲我们是在交易上失利的“负可敌国”小分队、创业间歇的“肥宅俱乐部”能在自己的人生过度和迷茫阶段能找到一个短暂的寄托,学到一点技能,交到一些朋友。

25 |

26 | 这中间经历过的故事,大家都是碎片化的视角,可能只有我一个人看到了全程。谁又真的在一年半前有信心,哪个方向的付出一定会开花结果?

27 |

28 | 我不知道别人怎么看,对于我唯一确定性的就是,我不会放弃这个想法,和这群一起上过战场的小伙伴,以后一定会给大家一个交代,不管大家在不在意我们能给予的仅有一点点。不能从资本家手中套利给到有贡献的小伙伴现金,那么我希望能至少过程中能给大家带来一种不同的人生体验,冲浪、开飞机、海盗船,说不定某一天这些也能计入human capital无形资产的一种?

29 |

30 | 难免每个组织随着时间的演变,参与个体或多或少都会在过程中从主观视角只看到自己付出的一面,而容易遗忘曾经获得的乐趣、友谊和知识。

31 |

32 | 我们在4月份也是因为由奶牛游戏脱生出来的,在EthSingapore获奖的Hashedge项目与@Jie85 偶遇。有了成熟开源社区参与者,CarboClan由一个自由人的自由联盟组织,演变成了现在的构建并维护区块链基础设施自由市场的黄帽社区。有了新成员,新视角,我们也尝试了更规范的社区流程,比如固定周例会,议程、会议纪要、GitHub流程。

33 |

34 | 没人想到我们最初迫于无奈通过参加黑客马拉松打造快闪组织打磨产品原型,能让我们的口碑加速度发酵。以至于这半年我们每两周都在有通过新的黑客马拉松加入黄帽的新成员和新项目。而且没有想到我们每一次都意外制造了一定范围内的行业爆款,从LSDai到WTF。其实从本质上看这些小爆款产品和我们这些新快闪组织及影响力,都与黄帽社区当时的小伙伴没有任何关系,但是我对自己有一个不成文的要求,不放在黄帽的GitHub中的项目,我个人不参与,如果不能给黄帽品牌组织带来口碑我不去折腾。而这些项目与黄帽社区的唯一连结,就是我们的周例会或者拉入项目群,向大家分享我们的进展。

35 |

36 | 在黄帽社区没有一个合理准入、分配、奖惩机制的时候,我们已经快要接不住了。而且更要命的是语言障碍、文化隔阂和信息同步的成本,更进一步降低了我们内部成员的认同感。

37 |

38 | 作为一个身体力行去实验研究组织形态有效性的人,我其实从一开始就渴望明确制定规则。但是恰恰是看到了高度不确定的环境下,太多的规则导致组织失去生命力的先例,且一直以来我们想要做的事在眼前的远方,如同滴满雨滴模糊的磨砂玻璃外的灯塔光晕一般闪烁,我知道那在哪里,却难以用语言准确捕捉所看到的景象。我希望保留最多的可能性,所以只是从价值观和我可控的维度来steer而没有制定黑白分明的rule。我想看看究竟我们会自我进化成一个什么样的组织。

39 |

40 | 所以,我们不得不变。当YellowHat社群升级为一个DAO的时候(首先我们在一月份要先设计出来这个DAO的机制),机制要严谨要能够形成强自选择以及价值观的正向循环。从效率导向角度来讲,希望黄帽社区的规则能简单易懂明确,准入机制明确,奖惩分明。各个子项目(各类快闪组织)描述清晰标准,社区投票筛选机制明确,进度分享清晰,需要的资源明确,等等(还有很多需要明确的)。

41 |

42 | 海盗Pirates DAO是一次黄帽精神的分叉,也是吸取了黄帽体外另一个爆款小实验WTFdao作为有倒计时期限的快闪组织的成功与其作为组织缺乏可持续momentum失败经验(作为品牌和meme,WTF成功了,作为一个可持续的组织,我们还没真正迈出第一步)。

43 |

44 | 原本是致敬海盗党Pirate Party,以及关于“create infinite inflation within a tx"的一种小众DeFi攻击策略的梗。为了能制造冬天在纽约的契机,通过长大版奶牛Hashedge给说服自己更好的一个理由坚持下去,我们不会有黄帽小伙伴从世界各地飞过来纽约用自己的剩余精力帮我们的Hashedge,入驻我们的海盗船。黄帽小伙伴有了黑客松战场上的革命友谊与事后协作的基础,而又经过反向自选择后的human capital的基数,才有了头部效应,才有了在昂贵的纽约租大airbnb的机会,让这么多human capital能在一个屋檐下,才有可能重组这群人不可被其工作项目完全捕获的人才剩余价值(surplus human capital),才有了浪迹各大洲打完比赛不知何时再见的海盗hacker们组织一起出海的机会。有了Pirate Party即便分开后不再相见,也会留下又一场社会实验的经验与教训,带着这份记忆各自承载彼此的印记,life goes on。

45 |

46 | 我很喜欢的一本书叫做Finite and Infinite Game。CoinCow、Hashedge、LSDai、WTF、Pi-Rate Party,这些narrative都是进化过程中的组织母体的产物与载体,是我们有意识的创造的给自己与给大家的🈶正向反馈回路的finite game。

47 |

48 | 我无法预知黄帽联盟这个社会协作实验会manifest成为什么形态,但至少是会是我们在遥远的未来无限逼近universal consciousness的一些渺小但不可抹去的尝试。

49 |

50 | 或许,对于社会组织形态的实验本身,就是我们为了生存而被动选择的infinite game。

51 |

--------------------------------------------------------------------------------

/notes/DeFi.WTF Banner.jpg:

--------------------------------------------------------------------------------

https://raw.githubusercontent.com/carboclan/pm/177fe4f82577091d7c3d7303dc64dd5d42d6da84/notes/DeFi.WTF Banner.jpg

--------------------------------------------------------------------------------

/notes/DeFiHackathonRecap.md:

--------------------------------------------------------------------------------

1 | # SF Blockchain Week - Defi Hackathon Recap

2 | ## TL;DR

3 | - The Defi Hackathon capped 2019 San Francisco Blockchain Week, with a total of 56 project submissions from over 400 hackers. Check out all submissions on [Devpost](https://defi-hackathon.devpost.com/submissions).

4 | - DeFi product innovation is getting sophisticated and fun! At least 3 projects building DeFi options/insurance, and 5 gamified DeFi constructs.

5 | - DeFi beyond Ethereum: 31 projects built on Cosmos.

6 | - Our project, [Liqui3D (Game of DEXes)](https://github.com/carboclan/liqui3d), won the Best project - Grand prize & Tier 1 prize for the Tendermint Cosmos Chanllenge.

7 |

8 | ## About Defi Hackathon 2019 @ SF Blockchain Week

9 | San Francisco Blockchain week is a week packed of talks, project showtimes and workshops. One of the unexpected highlight of the blockchain week has been an "unconference" - [Macro.WTF](http://macro.wtf/), which explored macroeconomic perspectives on crypto.

10 |

11 | SFBW climaxed with a Defi hackathon that attracted more than 400 hackers from all over the world who aim to transform the traditional financial products into transparent and permissionless solutions built upon decentralized networks.

12 |

13 | About 56 projects have been submitted at Defi Hackathon 2019. Cosmos attracted the greatest number of teams - a total of 31 projects competes for three tiers of the Cosmos challenges. The pie chart below shows the number of submissions by sponsors' challenge categories.

14 |

15 |

16 |

17 | Besides all the sponsor prizes, there is a grand prize that honors the best team who built the best product at this hackathon (yes, that's us!). This made us the only team who won both Tendermint Cosmos Challenge Tier 1 and the Grand Prize.

18 |

19 | ## Project Highlights - Top 5

20 | (Let me know if we missed anything) -> chuqiao: Is this part of the article or just a message to me? - article

21 |

22 | * ### [Liqui3D: Game of Dexes](https://github.com/carboclan/liqui3d) (Grand Prize Winner + Tendermint Cosmos Challenge Tier 1 Winner)

23 |