├── .gitignore

├── LICENSE

├── MANIFEST.in

├── README.md

├── examples

├── Black Scholes and Option Greeks.ipynb

├── README.ipynb

├── Visualizing Greeks.ipynb

└── visualizing-options-in-python-using-opstrat.ipynb

├── opstrat

├── __init__.py

├── basic_multi.py

├── basic_single.py

├── blackscholes.py

├── helpers.py

└── yf.py

├── readme_files

├── fig1.png

├── fig2.png

├── fig3.png

├── fig4.png

├── fig5.png

├── fig6.png

└── simple_option.jpeg

├── requirements.txt

└── setup.py

/.gitignore:

--------------------------------------------------------------------------------

1 | # Byte-compiled / optimized / DLL files

2 | __pycache__/

3 | *.py[cod]

4 | *$py.class

5 |

6 | # C extensions

7 | *.so

8 |

9 | #VS Code

10 | .vscode/

11 |

12 | # Distribution / packaging

13 | .Python

14 | env/

15 | build/

16 | develop-eggs/

17 | dist/

18 | downloads/

19 | eggs/

20 | .eggs/

21 | lib/

22 | lib64/

23 | parts/

24 | sdist/

25 | var/

26 | *.egg-info/

27 | .installed.cfg

28 | *.egg

29 |

30 | #My Files

31 | myfiles/

32 |

33 | # PyInstaller

34 | # Usually these files are written by a python script from a template

35 | # before PyInstaller builds the exe, so as to inject date/other infos into it.

36 | *.manifest

37 | *.spec

38 |

39 | # Installer logs

40 | pip-log.txt

41 | pip-delete-this-directory.txt

42 |

43 | # Unit test / coverage reports

44 | htmlcov/

45 | .tox/

46 | .coverage

47 | .coverage.*

48 | .cache

49 | nosetests.xml

50 | coverage.xml

51 | *,cover

52 | .hypothesis/

53 |

54 | # Translations

55 | *.mo

56 | *.pot

57 |

58 | # IPython Notebook

59 | .ipynb_checkpoints

60 |

61 | # pyenv

62 | .python-version

63 |

64 | # celery beat schedule file

65 | celerybeat-schedule

66 |

67 | # dotenv

68 | .env

69 |

70 | # virtualenv

71 | venv/

72 | ENV/

73 |

74 | # Spyder project settings

75 | .spyderproject

76 |

77 | # Rope project settings

78 | .ropeproject

79 | *.npy

80 | *.pkl

--------------------------------------------------------------------------------

/LICENSE:

--------------------------------------------------------------------------------

1 | MIT License

2 |

3 | Copyright (c) 2021 abhijith-git

4 |

5 | Permission is hereby granted, free of charge, to any person obtaining a copy

6 | of this software and associated documentation files (the "Software"), to deal

7 | in the Software without restriction, including without limitation the rights

8 | to use, copy, modify, merge, publish, distribute, sublicense, and/or sell

9 | copies of the Software, and to permit persons to whom the Software is

10 | furnished to do so, subject to the following conditions:

11 |

12 | The above copyright notice and this permission notice shall be included in all

13 | copies or substantial portions of the Software.

14 |

15 | THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND, EXPRESS OR

16 | IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

17 | FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE

18 | AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

19 | LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

20 | OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE

21 | SOFTWARE.

22 |

--------------------------------------------------------------------------------

/MANIFEST.in:

--------------------------------------------------------------------------------

1 | include README.md LICENSE

--------------------------------------------------------------------------------

/README.md:

--------------------------------------------------------------------------------

1 | # opstrat

2 |

3 | [](https://pypi.org/project/opstrat/)

4 | [](https://pypi.org/project/opstrat/)

5 | [](https://github.com/abhijith-git/opstrat)

6 | [](https://github.com/abhijith-git/opstrat)

7 | [](https://twitter.com/intent/user?screen_name=hashabcd)

8 | [](https://www.youtube.com/watch?v=EU3L4ziz3nk)

9 |

10 | Python library for visualizing options.

11 |

12 | ## Requirements

13 | pandas, numpy, matplotlib, seaborn, yfinance

14 |

15 |

16 | ## Installation

17 |

18 | Use the package manager [pip](https://pip.pypa.io/en/stable/) to install opstrat.

19 |

20 | ```bash

21 | pip install opstrat

22 | ```

23 |

24 | ## Usage

25 |

26 | ## Import opstrat

27 |

28 | ```python

29 | import opstrat

30 | ```

31 | ## Version check

32 | ```python

33 | op.__version__

34 | ```

35 | If you are using an older version upgrade to the latest package using:

36 | ```bash

37 | pip install opstrat --upgrade

38 | ```

39 |

40 | # 1. single_plotter()

41 | Used for plotting payoff diagram involving multiple options.

42 |

43 | Parameters

44 | ---

45 | op_type: kind {'c','p'}, default:'c'

46 | Opion type>> 'c': call option, 'p':put option

47 |

48 | spot: int, float, default: 100

49 | Spot Price

50 |

51 | spot_range: int, float, optional, default: 5

52 | Range of spot variation in percentage

53 |

54 | strike: int, float, default: 102

55 | Strike Price

56 |

57 | tr_type: kind {'b', 's'} default:'b'

58 | Transaction Type>> 'b': long, 's': short

59 |

60 | op_pr: int, float, default: 10

61 | Option Price

62 |

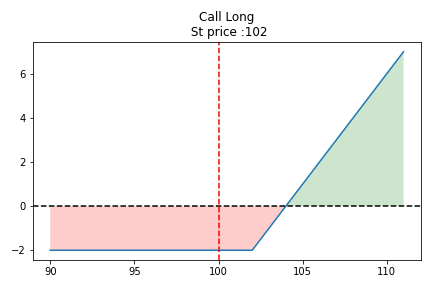

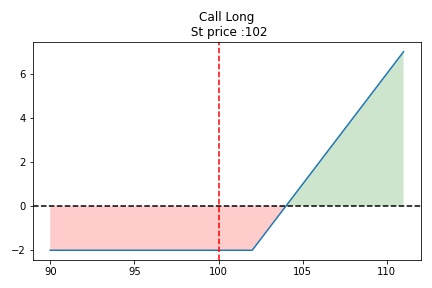

63 | ### 1.a Default plot

64 |

65 | Option type : Call

66 | Spot Price : 100

67 | Spot range : +/- 5%

68 | Strike price: 102

69 | Position : Long

70 | Option Premium: 10

71 | ```python

72 | op.single_plotter()

73 | ```

74 |

75 |

76 | Green : Profit

Red : Loss

77 |

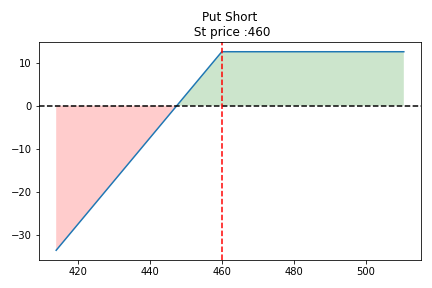

78 | ### 1.b Input parameters

79 | Strike Price : 450

80 | Spot price : 460

81 | Option type : Put Option

82 | Position : Short

83 | Option Premium : 12.5

84 |

85 | ```python

86 | op.single_plotter(spot=460, strike=460, op_type='p', tr_type='s', op_pr=12.5)

87 | ```

88 |

89 |

90 | # 2. multi_plotter()

91 |

92 | Used for plotting a single option

93 | Parameters

94 | ----------

95 | spot: int, float, default: 100

96 | Spot Price

97 |

98 | spot_range: int, float, optional, default: 20

99 | Range of spot variation in percentage

100 |

101 | op_list: list of dictionary

102 | Each dictionary must contiain following keys:

103 |

'strike': int, float, default: 720

104 |

Strike Price

105 |

'tr_type': kind {'b', 's'} default:'b'

106 |

Transaction Type>> 'b': long, 's': short

107 |

'op_pr': int, float, default: 10

108 |

Option Price

109 |

'op_type': kind {'c','p'}, default:'c'

110 |

Opion type>> 'c': call option, 'p':put option

111 |

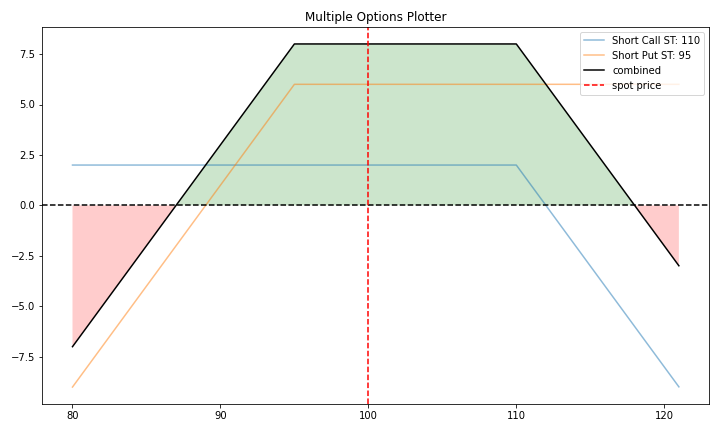

112 | ### 2.a Default plot : The short strangle

113 |

114 | Options trading that involve:

(a)selling of a slightly out-of-the-money put and

(b)a slightly out-of-the-money call of the same underlying stock and expiration date.

115 |

spot_range=+/-20%

116 |

spot=100

117 |

Option 1:Short call at strike price 110

op_type: 'c','strike': 110 'tr_type': 's', 'op_pr': 2

118 |

Option 2 : Short put at strike price 95

'op_type': 'p', 'strike': 95, 'tr_type': 's', 'op_pr': 6

119 |

120 | ```python

121 | op.multi_plotter()

122 | ```

123 |

124 |

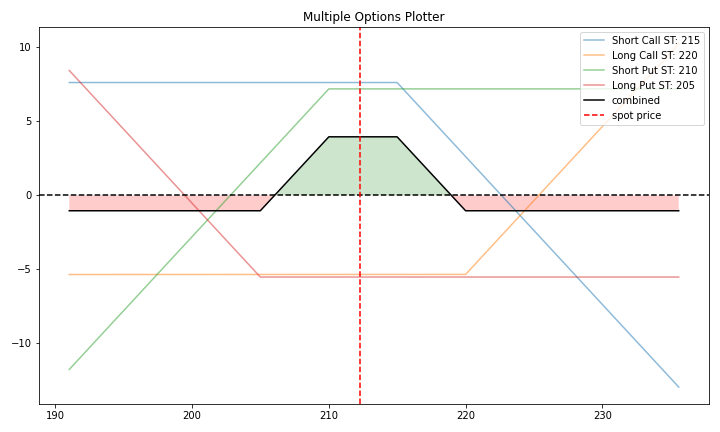

125 | ### 2.b Example: Iron Condor (Option strategy with 4 options)

126 |

127 | An iron condor is an options strategy consisting of two puts (one long and one short) and two calls (one long and one short), and four strike prices, all with the same expiration date.

128 |

129 | stock currently trading at 212.26 (Spot Price)

130 |

131 | Option 1: Sell a call with a 215 strike, which gives 7.63 in premium

132 | Option 2: Buy a call with a strike of 220, which costs 5.35.

133 | Option 3: Sell a put with a strike of 210 with premium received 7.20

134 | Option 4: Buy a put with a strike of 205 costing 5.52.

135 |

136 | ```python

137 | op1={'op_type': 'c', 'strike': 215, 'tr_type': 's', 'op_pr': 7.63}

138 | op2={'op_type': 'c', 'strike': 220, 'tr_type': 'b', 'op_pr': 5.35}

139 | op3={'op_type': 'p', 'strike': 210, 'tr_type': 's', 'op_pr': 7.20}

140 | op4={'op_type': 'p', 'strike': 205, 'tr_type': 'b', 'op_pr': 5.52}

141 |

142 | op_list=[op1, op2, op3, op4]

143 | op.multi_plotter(spot=212.26,spot_range=10, op_list=op_list)

144 | ```

145 |

146 |

147 | # 3. yf_plotter()

148 |

149 | Parameters

150 | ----------

151 | ticker: string, default: 'msft' stock ticker for Microsoft.Inc

152 | Stock Ticker

153 | exp: string default: next option expiration date

154 | Option expiration date in 'YYYY-MM-DD' format

155 |

156 | spot_range: int, float, optional, default: 10

157 | Range of spot variation in percentage

158 |

159 | op_list: list of dictionary

160 |

161 | Each dictionary must contiain following keys

162 | 'strike': int, float, default: 720

163 | Strike Price

164 | 'tr_type': kind {'b', 's'} default:'b'

165 | Transaction Type>> 'b': long, 's': short

166 | 'op_type': kind {'c','p'}, default:'c'

167 | Opion type>> 'c': call option, 'p':put option

168 |

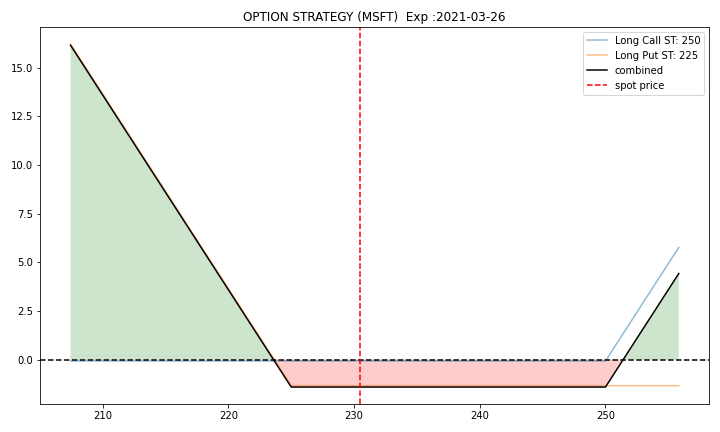

169 | ### 3.a Default plot

170 |

171 | Strangle on Microsoft stock

172 | Stock ticker : msft(Microsoft Inc.)

173 | Option 1: Buy Call at Strike Price 250

174 | Option 2: Buy Put option at Strike price 225

175 |

176 | ```python

177 | op.yf_plotter()

178 | ```

179 |

180 |

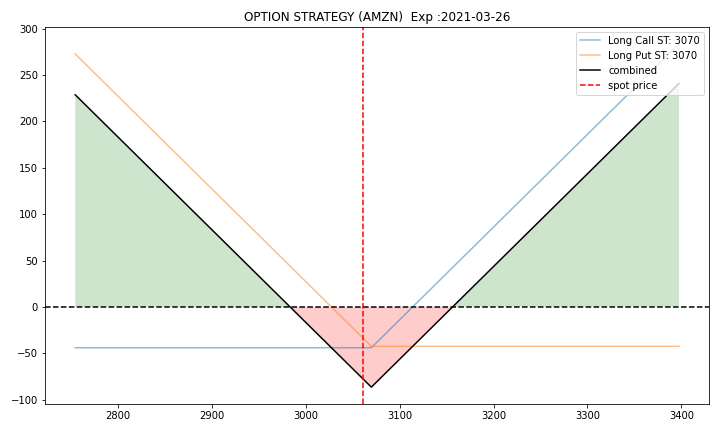

181 | ### 3.b Example: Strangle on Amazon

182 |

183 | Strangle:

184 | A simultaneous purchase of options to buy and to sell a security or commodity at a fixed price, allowing the purchaser to make a profit whether the price of the security or commodity goes up or down.

185 |

186 | Stock ticker : AMZN(Amazon Inc.)

187 | Option 1: Buy Call at Strike Price 3070

188 | Option 2: Buy Put option at Strike price 3070

189 |

190 | ```python

191 | op_1={'op_type': 'c', 'strike':3070, 'tr_type': 'b'}

192 | op_2={'op_type': 'p', 'strike':3070, 'tr_type': 'b'}

193 | op.yf_plotter(ticker='amzn',

194 | exp='default',

195 | op_list=[op_1, op_2])

196 | ```

197 |

198 |

199 | ## 4. Save figure

200 |

201 | Figure can be saved in the current directory setting save=True

202 | Filename with extension has to be provided as file.

203 | If no filename is provided, the figure will be saved as fig in png format.

204 | ```python

205 | op.single_plotter(save=True,file='simple_option.jpeg')

206 | ```

207 |

208 |

209 | ## Contributing

210 | Pull requests are welcome. For major changes, please open an issue first to discuss what you would like to change.

211 |

212 | Please make sure to update tests as appropriate.

213 |

214 | ## Content License

215 | [MIT](https://choosealicense.com/licenses/mit/)

216 |

217 | ### Thanks to

218 | [Stackoverflow Community](https://stackoverflow.com/)

219 | [Ran Aroussi](https://github.com/ranaroussi) : [yfinance](https://pypi.org/project/yfinance/)

220 | [Daniel Goldfarb](https://github.com/DanielGoldfarb) : [mplfinance](https://pypi.org/project/mplfinance/)

221 |

222 |

223 | ### Tutorial in Video Format

224 | [](https://youtu.be/EU3L4ziz3nk)

--------------------------------------------------------------------------------

/examples/Black Scholes and Option Greeks.ipynb:

--------------------------------------------------------------------------------

1 | {

2 | "cells": [

3 | {

4 | "cell_type": "markdown",

5 | "metadata": {},

6 | "source": [

7 | "### Import Libraries"

8 | ]

9 | },

10 | {

11 | "cell_type": "code",

12 | "execution_count": 1,

13 | "metadata": {

14 | "ExecuteTime": {

15 | "end_time": "2021-06-30T10:35:14.926145Z",

16 | "start_time": "2021-06-30T10:35:10.314481Z"

17 | }

18 | },

19 | "outputs": [

20 | {

21 | "name": "stderr",

22 | "output_type": "stream",

23 | "text": [

24 | "C:\\Users\\ABCD\\AppData\\Local\\Continuum\\anaconda3\\lib\\site-packages\\statsmodels\\tools\\_testing.py:19: FutureWarning: pandas.util.testing is deprecated. Use the functions in the public API at pandas.testing instead.\n",

25 | " import pandas.util.testing as tm\n"

26 | ]

27 | }

28 | ],

29 | "source": [

30 | "import opstrat as op"

31 | ]

32 | },

33 | {

34 | "cell_type": "markdown",

35 | "metadata": {},

36 | "source": [

37 | "### Declare parameters"

38 | ]

39 | },

40 | {

41 | "cell_type": "code",

42 | "execution_count": 2,

43 | "metadata": {

44 | "ExecuteTime": {

45 | "end_time": "2021-06-30T10:35:19.874732Z",

46 | "start_time": "2021-06-30T10:35:19.859400Z"

47 | }

48 | },

49 | "outputs": [],

50 | "source": [

51 | "K=200 #spot price\n",

52 | "St=208 #current stock price\n",

53 | "r=4 #4% risk free rate\n",

54 | "t=30 #time to expiry, 30 days \n",

55 | "v=20 #volatility \n",

56 | "type='c' #Option type call\n",

57 | "\n",

58 | "bsm=op.black_scholes(K=K, St=St, r=r, t=t, \n",

59 | " v=v, type='c')"

60 | ]

61 | },

62 | {

63 | "cell_type": "markdown",

64 | "metadata": {},

65 | "source": [

66 | "### Option values"

67 | ]

68 | },

69 | {

70 | "cell_type": "code",

71 | "execution_count": 3,

72 | "metadata": {

73 | "ExecuteTime": {

74 | "end_time": "2021-06-30T10:35:26.025687Z",

75 | "start_time": "2021-06-30T10:35:26.010472Z"

76 | }

77 | },

78 | "outputs": [

79 | {

80 | "data": {

81 | "text/plain": [

82 | "{'option value': 10.210518559926442,\n",

83 | " 'intrinsic value': 8,\n",

84 | " 'time value': 2.2105185599264416}"

85 | ]

86 | },

87 | "execution_count": 3,

88 | "metadata": {},

89 | "output_type": "execute_result"

90 | }

91 | ],

92 | "source": [

93 | "bsm['value']"

94 | ]

95 | },

96 | {

97 | "cell_type": "markdown",

98 | "metadata": {},

99 | "source": [

100 | "### Option Greeks"

101 | ]

102 | },

103 | {

104 | "cell_type": "code",

105 | "execution_count": 4,

106 | "metadata": {

107 | "ExecuteTime": {

108 | "end_time": "2021-06-30T10:35:33.797340Z",

109 | "start_time": "2021-06-30T10:35:33.786344Z"

110 | }

111 | },

112 | "outputs": [

113 | {

114 | "data": {

115 | "text/plain": [

116 | "{'delta': 0.7793593241701937,\n",

117 | " 'gamma': 0.024868265088898882,\n",

118 | " 'theta': -0.07559961986526405,\n",

119 | " 'vega': 0.17686037602292404,\n",

120 | " 'rho': 0.12484620893217029}"

121 | ]

122 | },

123 | "execution_count": 4,

124 | "metadata": {},

125 | "output_type": "execute_result"

126 | }

127 | ],

128 | "source": [

129 | "bsm['greeks']"

130 | ]

131 | },

132 | {

133 | "cell_type": "code",

134 | "execution_count": null,

135 | "metadata": {},

136 | "outputs": [],

137 | "source": []

138 | }

139 | ],

140 | "metadata": {

141 | "kernelspec": {

142 | "display_name": "Python 3",

143 | "language": "python",

144 | "name": "python3"

145 | },

146 | "language_info": {

147 | "codemirror_mode": {

148 | "name": "ipython",

149 | "version": 3

150 | },

151 | "file_extension": ".py",

152 | "mimetype": "text/x-python",

153 | "name": "python",

154 | "nbconvert_exporter": "python",

155 | "pygments_lexer": "ipython3",

156 | "version": "3.7.4"

157 | }

158 | },

159 | "nbformat": 4,

160 | "nbformat_minor": 2

161 | }

162 |

--------------------------------------------------------------------------------

/opstrat/__init__.py:

--------------------------------------------------------------------------------

1 | __version__ = "0.1.7"

2 | __author__ = "Abhijith Chandradas"

3 |

4 | from .basic_multi import *

5 | from .basic_single import *

6 | from .yf import *

7 | from .blackscholes import black_scholes

8 | #from .helpers import *

9 |

--------------------------------------------------------------------------------

/opstrat/basic_multi.py:

--------------------------------------------------------------------------------

1 | #multiplotter

2 | import numpy as np

3 | import matplotlib.pyplot as plt

4 | import seaborn as sns

5 |

6 | from .helpers import payoff_calculator, check_optype, check_trtype

7 |

8 | abb={'c': 'Call',

9 | 'p': 'Put',

10 | 'b': 'Long',

11 | 's': 'Short'}

12 |

13 | def multi_plotter(spot_range=20, spot=100,

14 | op_list=[{'op_type':'c','strike':110,'tr_type':'s','op_pr':2,'contract':1},

15 | {'op_type':'p','strike':95,'tr_type':'s','op_pr':6,'contract':1}],

16 | save=False, file='fig.png'):

17 | """

18 | Plots a basic option payoff diagram for a multiple options and resultant payoff diagram

19 |

20 | Parameters

21 | ----------

22 | spot: int, float, default: 100

23 | Spot Price

24 |

25 | spot_range: int, float, optional, default: 20

26 | Range of spot variation in percentage

27 |

28 | op_list: list of dictionary

29 |

30 | Each dictionary must contiain following keys

31 | 'strike': int, float, default: 720

32 | Strike Price

33 | 'tr_type': kind {'b', 's'} default:'b'

34 | Transaction Type>> 'b': long, 's': short

35 | 'op_pr': int, float, default: 10

36 | Option Price

37 | 'op_type': kind {'c','p'}, default:'c'

38 | Opion type>> 'c': call option, 'p':put option

39 | 'contracts': int default:1, optional

40 | Number of contracts

41 |

42 | save: Boolean, default False

43 | Save figure

44 |

45 | file: String, default: 'fig.png'

46 | Filename with extension

47 |

48 | Example

49 | -------

50 | op1={'op_type':'c','strike':110,'tr_type':'s','op_pr':2,'contract':1}

51 | op2={'op_type':'p','strike':95,'tr_type':'s','op_pr':6,'contract':1}

52 |

53 | import opstrat as op

54 | op.multi_plotter(spot_range=20, spot=100, op_list=[op1,op2])

55 |

56 | #Plots option payoff diagrams for each op1 and op2 and combined payoff

57 |

58 | """

59 | x=spot*np.arange(100-spot_range,101+spot_range,0.01)/100

60 | y0=np.zeros_like(x)

61 |

62 | y_list=[]

63 | for op in op_list:

64 | op_type=str.lower(op['op_type'])

65 | tr_type=str.lower(op['tr_type'])

66 | check_optype(op_type)

67 | check_trtype(tr_type)

68 |

69 | strike=op['strike']

70 | op_pr=op['op_pr']

71 | try:

72 | contract=op['contract']

73 | except:

74 | contract=1

75 | y_list.append(payoff_calculator(x, op_type, strike, op_pr, tr_type, contract))

76 |

77 |

78 | def plotter():

79 | y=0

80 | plt.figure(figsize=(10,6))

81 | for i in range (len(op_list)):

82 | try:

83 | contract=str(op_list[i]['contract'])

84 | except:

85 | contract='1'

86 |

87 | label=contract+' '+str(abb[op_list[i]['tr_type']])+' '+str(abb[op_list[i]['op_type']])+' ST: '+str(op_list[i]['strike'])

88 | sns.lineplot(x=x, y=y_list[i], label=label, alpha=0.5)

89 | y+=np.array(y_list[i])

90 |

91 | sns.lineplot(x=x, y=y, label='combined', alpha=1, color='k')

92 | plt.axhline(color='k', linestyle='--')

93 | plt.axvline(x=spot, color='r', linestyle='--', label='spot price')

94 | plt.legend()

95 | plt.legend(loc='upper right')

96 | title="Multiple Options Plotter"

97 | plt.title(title)

98 | plt.fill_between(x, y, 0, alpha=0.2, where=y>y0, facecolor='green', interpolate=True)

99 | plt.fill_between(x, y, 0, alpha=0.2, where=y> 'c': call option, 'p':put option

21 |

22 | spot: int, float, default: 100

23 | Spot Price

24 |

25 | spot_range: int, float, optional, default: 5

26 | Range of spot variation in percentage

27 |

28 | strike: int, float, default: 102

29 | Strike Price

30 |

31 | tr_type: kind {'b', 's'} default:'b'

32 | Transaction Type>> 'b': long, 's': short

33 |

34 | op_pr: int, float, default: 10

35 | Option Price

36 |

37 | save: Boolean, default False

38 | Save figure

39 |

40 | file: String, default: 'fig.png'

41 | Filename with extension

42 |

43 | Example

44 | -------

45 | import opstrat as op

46 | op.single_plotter(op_type='p', spot_range=20, spot=1000, strike=950)

47 | #Plots option payoff diagram for put option with spot price=1000, strike price=950, range=+/-20%

48 |

49 | """

50 |

51 |

52 | op_type=str.lower(op_type)

53 | tr_type=str.lower(tr_type)

54 | check_optype(op_type)

55 | check_trtype(tr_type)

56 |

57 | def payoff_calculator():

58 | x=spot*np.arange(100-spot_range,101+spot_range,0.01)/100

59 |

60 | y=[]

61 | if str.lower(op_type)=='c':

62 | for i in range(len(x)):

63 | y.append(max((x[i]-strike-op_pr),-op_pr))

64 | else:

65 | for i in range(len(x)):

66 | y.append(max(strike-x[i]-op_pr,-op_pr))

67 |

68 | if str.lower(tr_type)=='s':

69 | y=-np.array(y)

70 | return x,y

71 |

72 | x,y=payoff_calculator()

73 | y0=np.zeros_like(x)

74 |

75 | def plotter(x,y):

76 | plt.figure(figsize=(10,6))

77 | sns.lineplot(x=x, y=y)

78 | plt.axhline(color='k', linestyle='--')

79 | plt.axvline(x=spot, color='r', linestyle='--')

80 | title=str(abb[op_type])+' '+str(abb[tr_type])+'\n St price :'+str(strike)

81 | plt.fill_between(x, y, 0, alpha=0.2, where=y>y0, facecolor='green', interpolate=True)

82 | plt.fill_between(x, y, 0, alpha=0.2, where=y> 'b': long, 's': short

41 | 'op_type': kind {'c','p'}, default:'c'

42 | Opion type>> 'c': call option, 'p':put option

43 | 'contracts': int default:1, optional

44 | Number of contracts

45 |

46 | save: Boolean, default False

47 | Save figure

48 |

49 | file: String, default: 'fig.png'

50 | Filename with extension

51 |

52 | Example

53 | -------

54 | op1={'op_type':'c','strike':250,'tr_type':'b', 'contract':1}

55 | op2={'op_type':'p','strike':225,'tr_type':'b','contract':3}

56 |

57 | import opstrat as op

58 | op.yf_plotter(ticker='msft',exp='2021-03-26',spot_range=10, op_list=[op1,op2])

59 |

60 | #Plots option payoff diagrams for each op1 and op2 and combined payoff

61 |

62 | """

63 | #Check input and assigns spot price

64 | spot=check_ticker(ticker)

65 | #Expiry dates

66 | exp_list=yf.Ticker(ticker).options

67 |

68 | x=spot*np.arange(100-spot_range,101+spot_range,0.01)/100

69 | y0=np.zeros_like(x)

70 |

71 |

72 | def check_exp(exp):

73 | """

74 | Check expiry date

75 | """

76 | if exp not in exp_list:

77 | raise ValueError('Option for the given date not available!')

78 |

79 | if exp=='default':

80 | exp=yf.Ticker('msft').options[0]

81 | else:

82 | check_exp(exp)

83 |

84 | def check_strike(df, strike):

85 | if strike not in df.strike.unique():

86 | raise ValueError('Option for the given Strike Price not available!')

87 |

88 | y_list=[]

89 |

90 | for op in op_list:

91 | op_type=str.lower(op['op_type'])

92 | tr_type=str.lower(op['tr_type'])

93 |

94 | check_optype(op_type)

95 | check_trtype(tr_type)

96 |

97 | if(op_type=='p'):

98 | df=yf.Ticker(ticker).option_chain(exp).puts

99 | else:

100 | df=yf.Ticker(ticker).option_chain(exp).calls

101 |

102 | strike=op['strike']

103 | check_strike(df, strike)

104 | op_pr=df[df.strike==strike].lastPrice.sum()

105 | try:

106 | contract=op['contract']

107 | except:

108 | contract=1

109 |

110 | y_list.append(payoff_calculator(x, op_type, strike, op_pr, tr_type, contract))

111 |

112 |

113 | def plotter():

114 | y=0

115 | plt.figure(figsize=(10,6))

116 | for i in range (len(op_list)):

117 | try:

118 | contract=str(op_list[i]['contract'])

119 | except:

120 | contract='1'

121 |

122 | label=contract+' '+str(abb[op_list[i]['tr_type']])+' '+str(abb[op_list[i]['op_type']])+' ST: '+str(op_list[i]['strike'])

123 | sns.lineplot(x=x, y=y_list[i], label=label, alpha=0.5)

124 | y+=np.array(y_list[i])

125 |

126 | sns.lineplot(x=x, y=y, label='combined', alpha=1, color='k')

127 | plt.axhline(color='k', linestyle='--')

128 | plt.axvline(x=spot, color='r', linestyle='--', label='spot price')

129 | plt.legend()

130 | plt.legend(loc='upper right')

131 | title="OPTION STRATEGY ("+str.upper(ticker)+') '+' Exp :'+str(exp)

132 | plt.fill_between(x, y, 0, alpha=0.2, where=y>y0, facecolor='green', interpolate=True)

133 | plt.fill_between(x, y, 0, alpha=0.2, where=y